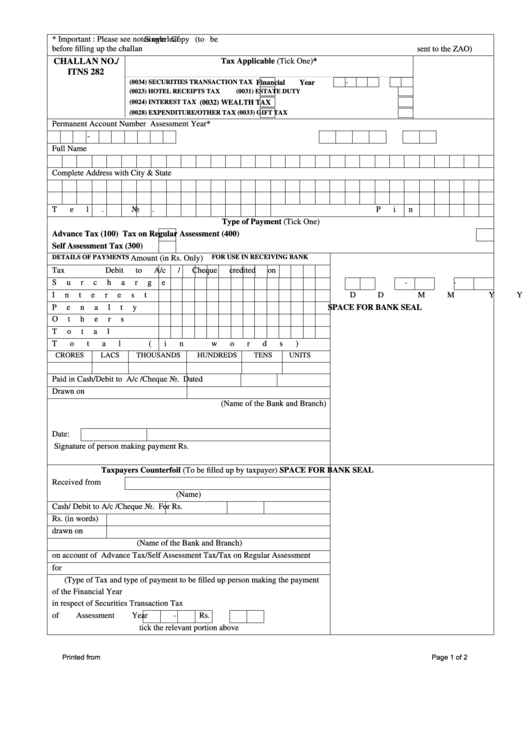

Challan No./ Itns 282 - Tax Form

ADVERTISEMENT

* Important : Please see notes overleaf

Single Copy (to be

before filling up the challan

sent to the ZAO)

CHALLAN NO./

Tax Applicable (Tick One)*

ITNS 282

(0034) SECURITIES TRANSACTION TAX

Financial Year

-

(0023) HOTEL RECEIPTS TAX

(0031) ESTATE DUTY

(0024) INTEREST TAX

(0032) WEALTH TAX

(0028) EXPENDITURE/OTHER TAX

(0033) GIFT TAX

Permanent Account Number

Assessment Year*

-

Full Name

Complete Address with City & State

Tel. No.

Pin

Type of Payment (Tick One)

Advance Tax (100)

Tax on Regular Assessment (400)

Self Assessment Tax (300)

DETAILS OF PAYMENTS

FOR USE IN RECEIVING BANK

Amount (in Rs. Only)

Tax

Debit to A/c / Cheque credited on

Surcharge

-

-

Interest

D

D

M

M

Y

Y

Penalty

SPACE FOR BANK SEAL

Others

Total

Total (in words)

CRORES

LACS

THOUSANDS

HUNDREDS

TENS

UNITS

Paid in Cash/Debit to A/c /Cheque No.

Dated

Drawn on

(Name of the Bank and Branch)

Date:

Signature of person making payment

Rs.

Taxpayers Counterfoil (To be filled up by taxpayer)

SPACE FOR BANK SEAL

Received from

(Name)

Cash/ Debit to A/c /Cheque No.

For Rs.

Rs. (in words)

drawn on

(Name of the Bank and Branch)

on account of

Advance Tax/Self Assessment Tax/Tax on Regular Assessment

for

(Type of Tax and type of payment to be filled up person making the payment

of the Financial Year

in respect of Securities Transaction Tax

of Assessment Year

-

Rs.

tick the relevant portion above

Printed from

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2