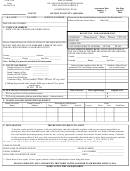

Drill Rig Declaration Schedule Page 3

ADVERTISEMENT

16 DPT – AS

STATE OF COLORADO

FORM DS 656A 02-16

GENERAL INFORMATION

[Declaration Schedules and Attachments Are Confidential And Private Documents By Law.]

NOTE: THIS SCHEDULE IS NOT TO BE USED FOR DECLARING TRUCK-MOUNTED DRILLING RIGS.

For these instructions, please refer to the following statutes: §§ 39-3-118.5, 39-3-119.5, 39-5-104.5, 39-5-104.7, 39-5-107, 39-5-108, 39-5-110, 39-5-113 through 117, 39-5-120,

and 39-21-113(7), C.R.S.

WHO FILES A DECLARATION SCHEDULE? All owners and/or operators of oil or gas skid-mounted rotary drilling rigs that have been operated, stored (stacked), or

maintained in a Colorado county during the prior calendar year must file this schedule. In addition, the owner of all personal property as of January 1 must file a declaration

schedule. All taxable personal property, such as leased or owned equipment that accompanies the drilling rig, must be listed on this schedule. Use one declaration schedule per

drilling rig.

ARE YOU A NEW OWNER? If you answer "yes" to this question or you have never filed with the county assessor, you are required to provide a complete listing of the drilling

rig, any auxiliary equipment, and any other personal property used in conjunction with the drilling rig in Colorado. For auxiliary or leased personal property, please include:

Item ID Number Property Description Model Number Year Acquired Original Installed Cost To You, and If the Property Was Not Put Into Use as of January 1 of

the current year.

APPORTIONMENT OF DRILLING RIG VALUES

Drilling Rigs can only be valued for the days they were traveling in, were operated or maintained within, or were stored (stacked) in Colorado. The assessor in the county of

original assessment (COA) values the rig and apportions the value among the counties listed on the drilling log. This apportionment is accomplished by multiplying the calculated

total actual value per day by the number of days the rig was located in each county during the previous calendar year. On or before June 15, the assessor of the COA furnishes a

copy of the actual valuation of the rig, the apportionment working papers, and the Notice of Valuation (NOV) for the COA-apportioned actual value to the owner or operator. The

assessor of the COA also sends the actual valuation, apportionment working papers, and copies of the drilling log to every county assessor involved. These assessors send their

NOV’s for their apportioned actual values to the taxpayer on or before June 15.

WHEN DO YOU FILE? This form must be received by the county assessor by the April 15 deadline EVERY YEAR that the rig is operated, stored (stacked), or maintained in

Colorado.

HOW DO YOU FILE FOR AN EXTENSION AND WHAT HAPPENS IF YOU FAIL TO FILE? You may extend the deadline if, prior to April 15, the assessor receives

your written request AND $20 for a 10-day extension, or $40 for a 20-day extension. This extension applies to all drilling rig schedules that a person is required to file in the

county. The late filing penalty is $50, or 15% of the taxes due, whichever is less. If you fail to file a schedule, the assessor may determine a valuation based upon the BEST

INFORMATION AVAILABLE and may add a penalty of up to 25% of assessed value for any omitted property discovered and valued later.

NOTE: Failure to properly file a declaration schedule may prevent you from receiving an abatement per Colorado case law. Property Tax Adm’r v. Production

Geophysical, 860 P.2d 514 (Colo. 1993)

WHY IS THE DECLARATION FORM IMPORTANT? Assessors use this information to help calculate the skid-mounted rotary drilling rig's actual value. This value is based

on the rig's use and condition as of January 1 of the previous calendar year, or as of the date that the drilling rig first was operated, stored (stacked), or maintained in a Colorado

county during prior assessment year.

WHAT HAPPENS AFTER YOU SUBMIT THIS FORM? The assessor may request more information or conduct a physical inventory inspection of the drilling rig at its

location.

Notices of Valuation are mailed on June 15 to the address listed on this schedule.

INSTRUCTIONS FOR COMPLETING THE OIL AND GAS ROTARY DRILLING RIG DECLARATION SCHEDULE, DS 656

A.

NAME AND ADDRESS: Write any corrections to the preprinted name/address information under Change of Name or Address. If you are not the current business owner,

please list the name and address of the new owner in the appropriate box. Also, list the date that the property was sold to the new owner. Provide the legal description

(including name of county, section, range, township, and quarter section) of the physical location of the drilling rig on January 1, 2016, or on the date the drilling rig first

entered a Colorado county where the rig was operated, stored (stacked), or maintained. Drilling rigs are assessed if they were operated, stored, or maintained in any Colorado

county during the year 2016. A copy of the drilling log that accompanies the drilling rig must be attached to this declaration, § 39-5-113.3(1), C.R.S.

B.

LOCATION ON FILING DATE: Provide the legal description (including name of county, section, range, township, and quarter section) of the physical location of the

drilling rig at the time of filing this declaration.

C.

COUNTY OF ORIGINAL ASSESSMENT (COA): This section pertains to the Colorado County where the drilling rig first began drilling in 2016. As of January 1, 2016,

or as of the date the drilling rig first entered a Colorado county where the rig was operated, stored (stacked), or maintained, please list the following:

Depth Capacity or drilling depth for which the rig is rated.

Number of drill collars accompanying the rig.

Number of linear feet of drill pipe accompanying the rig.

Condition of Rig according to the criteria listed below:

Poor/Stacked: Has seen very hard and long hours of service. Requires rebuild, repair, or overhaul before it can be used. Not operational or functional. Stacked rigs are

those rigs that have been dismantled, the components have been stacked together over a year, and are in poor condition. Because of stacking, these rigs show additional

physical deterioration that will require repairs and/or maintenance to begin operation.

Fair: Has very high hours indicating extended use. D efects are obvious and will require repair or general rebuilding soon. Not 100% functional or efficient, may be

operational or functional, but questionable as to how long this will continue.

Good: Operating condition is 100%. No known or obvious mechanical defects, but the rig may have some minor worn parts that will need repair or replacement in the

near future. May have high hours of use, but no defects are obvious.

Very Good: The rig is like new or is nearly new with only minimal hours of operation There is no need of repair or replacement of parts. This may include rebuilt rigs

that have been completely refurbished to top operating condition.

D.

HIGH-TECHNOLOGY DRILLING RIGS: Check type of rig and include the date placed in service, maximum depth rating, and original cost. List auxiliar y equipment

on a separate sheet.

( DO NOT COMPLETE THIS FORM FOR RIGS THAT HAVE BEEN GIVEN “SPECIAL MOBILE MACHINERY” (SMM) TAGS OR LICENSES. )

E.

LEASED, LOANED, OR RENTED EQUIPMENT: You must identify any leased, loaned, or rented equipment accompanying the drilling rig, as follows:

Owner’s/Lessor’s Name, Address, and Telephone Number

Description of Equipment, Including Type, Model Number, and Serial Number

Lease:

Total Cost of the Lease to You

Lease Number

Lease Term (From-To)

Total Amount of Annual Rent

If any of the leased equipment listed is capitalized on your books and records, please check the box at the beginning of the line corresponding with the name of the Lessor.

Also, if purchase or maintenance options are included in the lease, check this box and provide details of these options on a separate sheet. Property rented 30 days at a time

or less, returned at the renter’s option, and for which sales/use tax is collected before it is finally sold is considered exempt and should NOT be reported.

F.

.

DECLARATION AND SIGNATURE: Print the personal property owner’s Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

Print name

of owner, name of person signing, phone number, and e-mail address. Then sign, date, and return this form to the assessor by April 15th. §39-5-107, C.R.S.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3