Michigan Department of Treasury (Rev. 05-15)

Issued under authority of Public Act 281 of 1967, as amended.

2016 MI-1040ES, Michigan Estimated Income Tax for Individuals

NOTE: If you are married and plan to file your annual return as “married, filing separately,” DO NOT use preprinted vouchers

containing the Social Security Numbers (SSN) or correspondence identification numbers for both you and your spouse; separate

vouchers and payments must be submitted for each filer.

Who Must File Estimated Tax Payments

How to Pay Estimated Tax

You must make estimated income tax payments if you

e-Payments

expect to owe more than $500 when you file your 2016 MI-

You may choose to make your estimated income tax

1040 return.

payments electronically instead of mailing a payment with

If you owe more than $500, you may not have to make

the personalized form provided. Paying electronically

estimated payments if you expect your 2016 withholding to

is easy, fast and secure. Payment options include direct

be at least:

debit (eCheck) from your checking or savings account, or

• 90 percent of your total 2016 tax (qualified farmers,

payment by credit or debit card. If you choose to make

fishermen and seafarers use 66 2/3 percent),

your payment electronically, you do not need to mail the

• 100 percent of your 2015 tax, or

MI-1040ES form to Treasury. Visit

• 110 percent of your total 2015 tax if your 2015 adjusted

for more information.

gross income is more than $150,000 ($75,000 for married

Mail Your Payment

filing separately).

If you choose to mail your payment, make your check

Total 2015 tax is the amount on your 2015 MI-1040, line 21

payable to “State of Michigan.” Print the last four digits

less the sum of your tax credits on lines 25, 26, 27b, and 28.

of your SSN and “2016 MI-1040ES” on the check. If

Estimated tax payments are not needed if two-thirds of

paying on behalf of another filer, write the filer’s name

your gross income is from farming, fishing or seafaring and

and the last four digits of the filer’s SSN on the check. For

you meet the qualifications.

accurate processing of your payment, do not combine this

Estimate filing requirements apply whether or not you are a

payment with any other payments. Send your check with

Michigan resident.

the MI-1040ES voucher for that installment. Do not staple

Do not submit this form for any quarter that you do not

your check to the voucher.

have estimated tax due.

Send your voucher and check to:

Michigan Department of Treasury

Payment Due Dates

P.O. Box 30774

You may pay in full with the first estimate voucher due

Lansing, MI 48909-8274

April 18, 2016. You may also pay in equal installments

due on or before April 18, 2016,

June 15, 2016,

September 15, 2016, and January 17, 2017.

NOTE: You will not receive reminder notices; save this

set of forms for all of your 2016 payments.

Reset Form

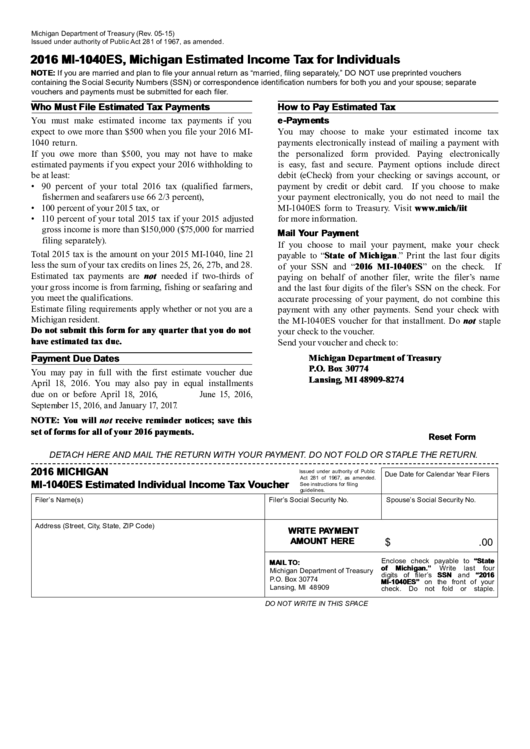

DETACH HERE AND MAIL THE RETURN WITH YOUR PAYMENT. DO NOT FOLD OR STAPLE THE RETURN.

2016 MICHIGAN

Issued under authority of Public

Due Date for Calendar Year Filers

Act 281 of 1967, as amended.

MI-1040ES Estimated Individual Income Tax Voucher

See instructions for filing

guidelines.

Filer’s Name(s)

Filer’s Social Security No.

Spouse’s Social Security No.

Address (Street, City, State, ZIP Code)

WRITE PAYMENT

AMOUNT HERE

$

.00

Enclose check payable to “State

MAIL TO:

of

Michigan.”

Write

last

four

Michigan Department of Treasury

digits of filer’s SSN and “2016

P.O. Box 30774

MI-1040ES” on the front of your

Lansing, MI 48909

check. Do not fold or staple.

DO NOT WRITE IN THIS SPACE

1

1