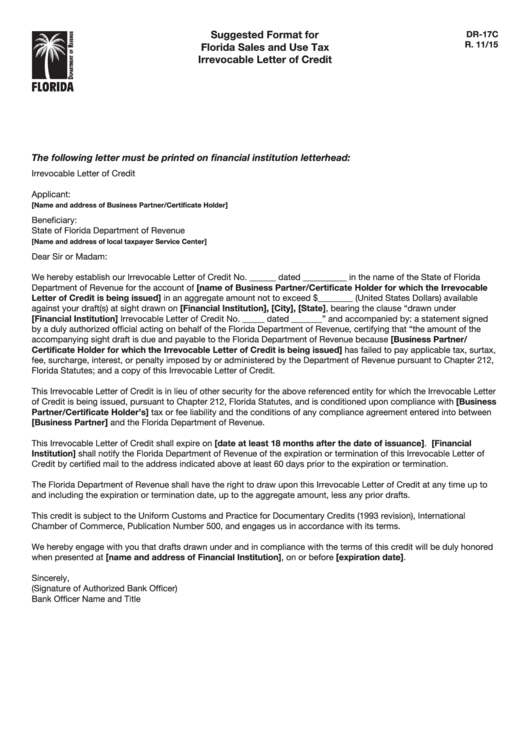

Suggested Format For Florida Sales And Use Tax Irrevocable Letter Of Credit

ADVERTISEMENT

Suggested Format for

DR-17C

R. 11/15

Florida Sales and Use Tax

Irrevocable Letter of Credit

The following letter must be printed on financial institution letterhead:

Irrevocable Letter of Credit

Applicant:

[Name and address of Business Partner/Certificate Holder]

Beneficiary:

State of Florida Department of Revenue

[Name and address of local taxpayer Service Center]

Dear Sir or Madam:

We hereby establish our Irrevocable Letter of Credit No. ______ dated __________ in the name of the State of Florida

Department of Revenue for the account of [name of Business Partner/Certificate Holder for which the Irrevocable

Letter of Credit is being issued] in an aggregate amount not to exceed $________ (United States Dollars) available

against your draft(s) at sight drawn on [Financial Institution], [City], [State], bearing the clause “drawn under

[Financial Institution] Irrevocable Letter of Credit No. _____ dated _______” and accompanied by: a statement signed

by a duly authorized official acting on behalf of the Florida Department of Revenue, certifying that “the amount of the

accompanying sight draft is due and payable to the Florida Department of Revenue because [Business Partner/

Certificate Holder for which the Irrevocable Letter of Credit is being issued] has failed to pay applicable tax, surtax,

fee, surcharge, interest, or penalty imposed by or administered by the Department of Revenue pursuant to Chapter 212,

Florida Statutes; and a copy of this Irrevocable Letter of Credit.

This Irrevocable Letter of Credit is in lieu of other security for the above referenced entity for which the Irrevocable Letter

of Credit is being issued, pursuant to Chapter 212, Florida Statutes, and is conditioned upon compliance with [Business

Partner/Certificate Holder’s] tax or fee liability and the conditions of any compliance agreement entered into between

[Business Partner] and the Florida Department of Revenue.

This Irrevocable Letter of Credit shall expire on [date at least 18 months after the date of issuance]. [Financial

Institution] shall notify the Florida Department of Revenue of the expiration or termination of this Irrevocable Letter of

Credit by certified mail to the address indicated above at least 60 days prior to the expiration or termination.

The Florida Department of Revenue shall have the right to draw upon this Irrevocable Letter of Credit at any time up to

and including the expiration or termination date, up to the aggregate amount, less any prior drafts.

This credit is subject to the Uniform Customs and Practice for Documentary Credits (1993 revision), International

Chamber of Commerce, Publication Number 500, and engages us in accordance with its terms.

We hereby engage with you that drafts drawn under and in compliance with the terms of this credit will be duly honored

when presented at [name and address of Financial Institution], on or before [expiration date].

Sincerely,

(Signature of Authorized Bank Officer)

Bank Officer Name and Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1