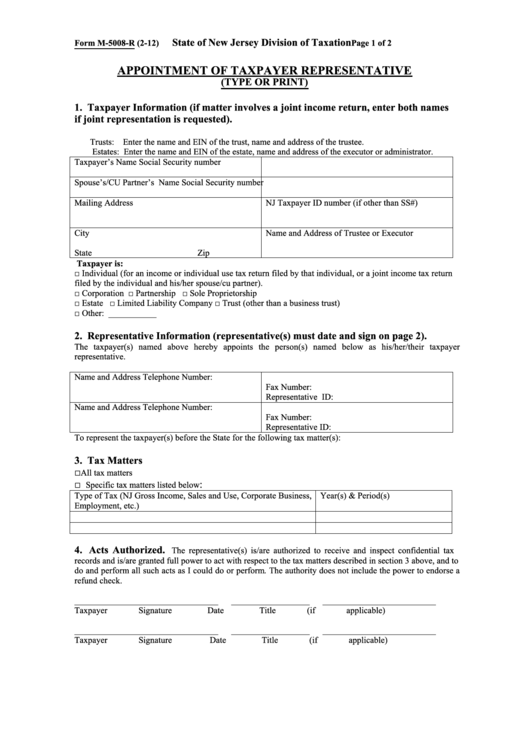

State of New Jersey Division of Taxation

Form M-5008-R (2-12)

Page 1 of 2

APPOINTMENT OF TAXPAYER REPRESENTATIVE

(TYPE OR PRINT)

1. Taxpayer Information (if matter involves a joint income return, enter both names

if joint representation is requested).

Trusts: Enter the name and EIN of the trust, name and address of the trustee.

Estates: Enter the name and EIN of the estate, name and address of the executor or administrator.

Taxpayer’s Name

Social Security number

Spouse’s/CU Partner’s Name

Social Security number

Mailing Address

NJ Taxpayer ID number (if other than SS#)

City

Name and Address of Trustee or Executor

State

Zip

Taxpayer is:

□ Individual (for an income or individual use tax return filed by that individual, or a joint income tax return

filed by the individual and his/her spouse/cu partner).

□ Corporation

□ Partnership

□ Sole Proprietorship

□ Estate

□ Limited Liability Company

□ Trust (other than a business trust)

□ Other: ___________

2. Representative Information (representative(s) must date and sign on page 2).

The taxpayer(s) named above hereby appoints the person(s) named below as his/her/their taxpayer

representative.

Name and Address

Telephone Number:

Fax Number:

Representative ID:

Name and Address

Telephone Number:

Fax Number:

Representative ID:

To represent the taxpayer(s) before the State for the following tax matter(s):

3. Tax Matters

□

All tax matters

□

:

Specific tax matters listed below

Type of Tax (NJ Gross Income, Sales and Use, Corporate Business,

Year(s) & Period(s)

Employment, etc.)

4. Acts Authorized.

The representative(s) is/are authorized to receive and inspect confidential tax

records and is/are granted full power to act with respect to the tax matters described in section 3 above, and to

do and perform all such acts as I could do or perform. The authority does not include the power to endorse a

refund check.

_________________________________

__________________

__________________________

Taxpayer Signature

Date

Title (if applicable)

_________________________________

__________________

__________________________

Taxpayer Signature

Date

Title (if applicable)

1

1 2

2 3

3 4

4