Instructions For Form W-8ben - Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting (Individuals) - 2014

ADVERTISEMENT

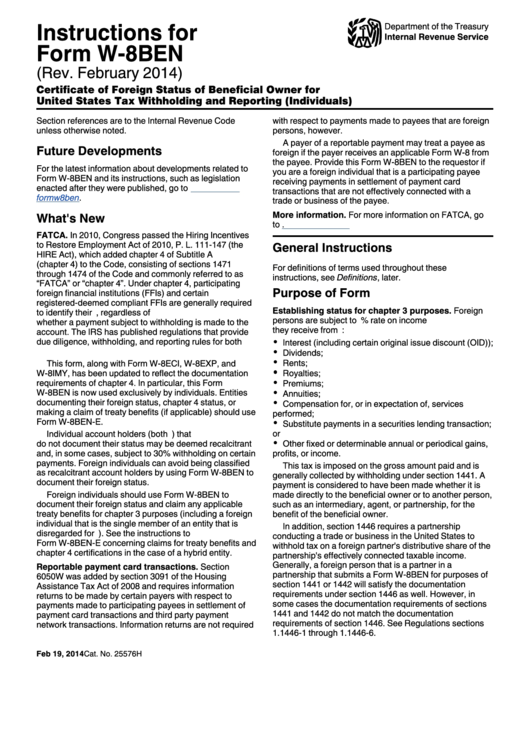

Instructions for

Department of the Treasury

Internal Revenue Service

Form W-8BEN

(Rev. February 2014)

Certificate of Foreign Status of Beneficial Owner for

United States Tax Withholding and Reporting (Individuals)

Section references are to the Internal Revenue Code

with respect to payments made to payees that are foreign

unless otherwise noted.

persons, however.

A payer of a reportable payment may treat a payee as

Future Developments

foreign if the payer receives an applicable Form W-8 from

the payee. Provide this Form W-8BEN to the requestor if

For the latest information about developments related to

you are a foreign individual that is a participating payee

Form W-8BEN and its instructions, such as legislation

receiving payments in settlement of payment card

enacted after they were published, go to

transactions that are not effectively connected with a U.S.

formw8ben.

trade or business of the payee.

More information. For more information on FATCA, go

What's New

to fatca.

FATCA. In 2010, Congress passed the Hiring Incentives

to Restore Employment Act of 2010, P. L. 111-147 (the

General Instructions

HIRE Act), which added chapter 4 of Subtitle A

(chapter 4) to the Code, consisting of sections 1471

For definitions of terms used throughout these

through 1474 of the Code and commonly referred to as

instructions, see Definitions, later.

“FATCA” or “chapter 4”. Under chapter 4, participating

Purpose of Form

foreign financial institutions (FFIs) and certain

registered-deemed compliant FFIs are generally required

Establishing status for chapter 3 purposes. Foreign

to identify their U.S. account holders, regardless of

persons are subject to U.S. tax at a 30% rate on income

whether a payment subject to withholding is made to the

they receive from U.S. sources that consists of:

account. The IRS has published regulations that provide

due diligence, withholding, and reporting rules for both

Interest (including certain original issue discount (OID));

U.S. withholding agents and FFIs under chapter 4.

Dividends;

Rents;

This form, along with Form W-8ECI, W-8EXP, and

W-8IMY, has been updated to reflect the documentation

Royalties;

requirements of chapter 4. In particular, this Form

Premiums;

W-8BEN is now used exclusively by individuals. Entities

Annuities;

documenting their foreign status, chapter 4 status, or

Compensation for, or in expectation of, services

making a claim of treaty benefits (if applicable) should use

performed;

Form W-8BEN-E.

Substitute payments in a securities lending transaction;

or

Individual account holders (both U.S. and foreign) that

do not document their status may be deemed recalcitrant

Other fixed or determinable annual or periodical gains,

and, in some cases, subject to 30% withholding on certain

profits, or income.

payments. Foreign individuals can avoid being classified

This tax is imposed on the gross amount paid and is

as recalcitrant account holders by using Form W-8BEN to

generally collected by withholding under section 1441. A

document their foreign status.

payment is considered to have been made whether it is

Foreign individuals should use Form W-8BEN to

made directly to the beneficial owner or to another person,

document their foreign status and claim any applicable

such as an intermediary, agent, or partnership, for the

treaty benefits for chapter 3 purposes (including a foreign

benefit of the beneficial owner.

individual that is the single member of an entity that is

In addition, section 1446 requires a partnership

disregarded for U.S. tax purposes). See the instructions to

conducting a trade or business in the United States to

Form W-8BEN-E concerning claims for treaty benefits and

withhold tax on a foreign partner's distributive share of the

chapter 4 certifications in the case of a hybrid entity.

partnership's effectively connected taxable income.

Generally, a foreign person that is a partner in a

Reportable payment card transactions. Section

partnership that submits a Form W-8BEN for purposes of

6050W was added by section 3091 of the Housing

section 1441 or 1442 will satisfy the documentation

Assistance Tax Act of 2008 and requires information

requirements under section 1446 as well. However, in

returns to be made by certain payers with respect to

some cases the documentation requirements of sections

payments made to participating payees in settlement of

1441 and 1442 do not match the documentation

payment card transactions and third party payment

requirements of section 1446. See Regulations sections

network transactions. Information returns are not required

1.1446-1 through 1.1446-6.

Feb 19, 2014

Cat. No. 25576H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8