Dr1 Florida Business Tax Application

ADVERTISEMENT

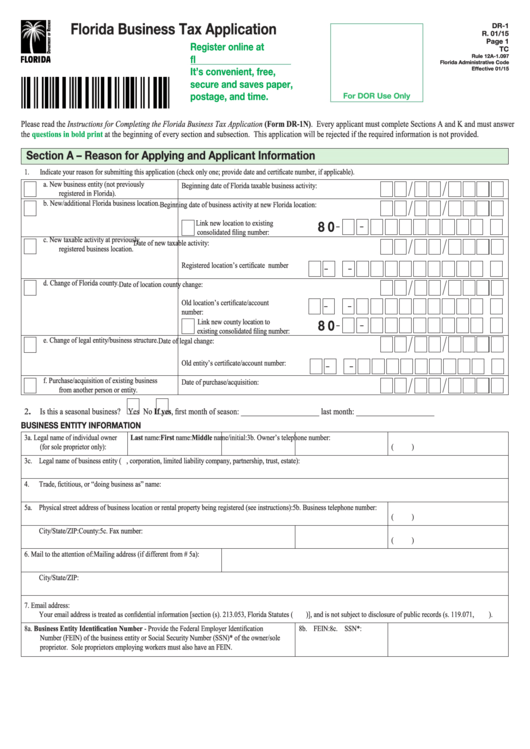

Florida Business Tax Application

DR-1

R. 01/15

Page 1

Register online at

TC

Rule 12A-1.097

Florida Administrative Code

It’s convenient, free,

Effective 01/15

secure and saves paper,

postage, and time.

For DOR Use Only

Please read the Instructions for Completing the Florida Business Tax Application (Form DR-1N). Every applicant must complete Sections A and K and must answer

questions in bold print

the

at the beginning of every section and subsection. This application will be rejected if the required information is not provided.

Section A – Reason for Applying and Applicant Information

1.

Indicate your reason for submitting this application (check only one; provide date and certificate number, if applicable).

a.

New business entity (not previously

Beginning date of Florida taxable business activity:

registered in Florida).

b.

New/additional Florida business location.

Beginning date of business activity at new Florida location:

Link new location to existing

8 0

–

–

consolidated filing number:

c.

New taxable activity at previously

Date of new taxable activity:

registered business location.

Registered location’s certificate number

–

–

d.

Change of Florida county.

Date of location county change:

Old location’s certificate/account

–

–

number:

Link new county location to

8 0

–

–

existing consolidated filing number:

e.

Change of legal entity/business structure.

Date of legal change:

Old entity’s certificate/account number:

–

–

f.

Purchase/acquisition of existing business

Date of purchase/acquisition:

from another person or entity.

2. Is this a seasonal business?

Yes

No If yes, first month of season: _____________________ last month: _____________________

BUSINESS ENTITY INFORMATION

3a. Legal name of individual owner

Last name:

First name:

Middle name/initial:

3b. Owner’s telephone number:

(for sole proprietor only):

( )

3c. Legal name of business entity (e.g., corporation, limited liability company, partnership, trust, estate):

4. Trade, fictitious, or “doing business as” name:

5a. Physical street address of business location or rental property being registered (see instructions):

5b. Business telephone number:

( )

City/State/ZIP:

County:

5c. Fax number:

( )

6.

Mail to the attention of:

Mailing address (if different from # 5a):

City/State/ZIP:

7.

Email address:

Your email address is treated as confidential information [section (s). 213.053, Florida Statutes (F.S.)], and is not subject to disclosure of public records (s. 119.071, F.S.).

8a. Business Entity Identification Number - Provide the Federal Employer Identification

8b. FEIN:

8c. SSN*:

Number (FEIN) of the business entity or Social Security Number (SSN)* of the owner/sole

proprietor. Sole proprietors employing workers must also have an FEIN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10