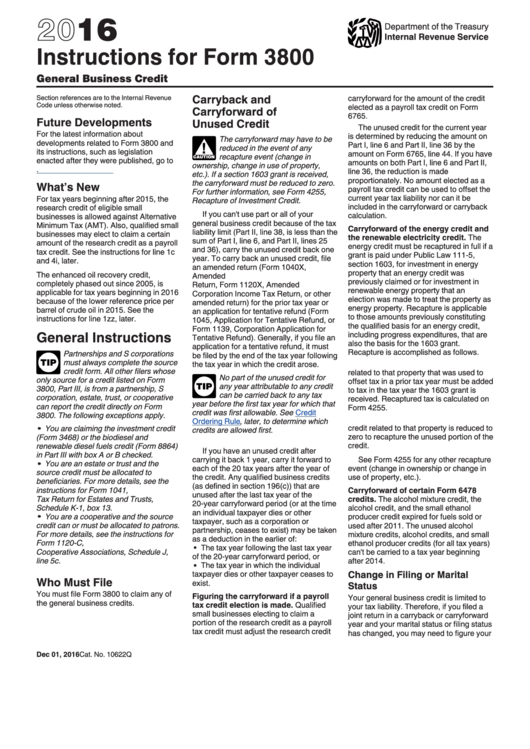

Instructions For Form 3800 - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 3800

General Business Credit

Carryback and

carryforward for the amount of the credit

Section references are to the Internal Revenue

Code unless otherwise noted.

elected as a payroll tax credit on Form

Carryforward of

6765.

Future Developments

Unused Credit

The unused credit for the current year

For the latest information about

is determined by reducing the amount on

The carryforward may have to be

developments related to Form 3800 and

Part I, line 6 and Part II, line 36 by the

reduced in the event of any

!

its instructions, such as legislation

amount on Form 6765, line 44. If you have

recapture event (change in

enacted after they were published, go to

CAUTION

amounts on both Part I, line 6 and Part II,

ownership, change in use of property,

line 36, the reduction is made

etc.). If a section 1603 grant is received,

proportionately. No amount elected as a

the carryforward must be reduced to zero.

What’s New

payroll tax credit can be used to offset the

For further information, see Form 4255,

current year tax liability nor can it be

For tax years beginning after 2015, the

Recapture of Investment Credit.

included in the carryforward or carryback

research credit of eligible small

If you can't use part or all of your

calculation.

businesses is allowed against Alternative

general business credit because of the tax

Minimum Tax (AMT). Also, qualified small

Carryforward of the energy credit and

liability limit (Part II, line 38, is less than the

businesses may elect to claim a certain

the renewable electricity credit. The

sum of Part I, line 6, and Part II, lines 25

amount of the research credit as a payroll

energy credit must be recaptured in full if a

and 36), carry the unused credit back one

tax credit. See the instructions for line 1c

grant is paid under Public Law 111-5,

year. To carry back an unused credit, file

and 4i, later.

section 1603, for investment in energy

an amended return (Form 1040X,

property that an energy credit was

The enhanced oil recovery credit,

Amended U.S. Individual Income Tax

previously claimed or for investment in

completely phased out since 2005, is

Return, Form 1120X, Amended U.S.

renewable energy property that an

applicable for tax years beginning in 2016

Corporation Income Tax Return, or other

election was made to treat the property as

because of the lower reference price per

amended return) for the prior tax year or

energy property. Recapture is applicable

barrel of crude oil in 2015. See the

an application for tentative refund (Form

to those amounts previously constituting

instructions for line 1zz, later.

1045, Application for Tentative Refund, or

the qualified basis for an energy credit,

Form 1139, Corporation Application for

General Instructions

including progress expenditures, that are

Tentative Refund). Generally, if you file an

also the basis for the 1603 grant.

application for a tentative refund, it must

Recapture is accomplished as follows.

Partnerships and S corporations

be filed by the end of the tax year following

must always complete the source

1. Any portion of the energy credit

the tax year in which the credit arose.

TIP

credit form. All other filers whose

related to that property that was used to

No part of the unused credit for

only source for a credit listed on Form

offset tax in a prior tax year must be added

any year attributable to any credit

3800, Part III, is from a partnership, S

TIP

to tax in the tax year the 1603 grant is

can be carried back to any tax

corporation, estate, trust, or cooperative

received. Recaptured tax is calculated on

year before the first tax year for which that

can report the credit directly on Form

Form 4255.

credit was first allowable. See

Credit

3800. The following exceptions apply.

2. Any carryforward of the energy

Ordering

Rule, later, to determine which

credit related to that property is reduced to

You are claiming the investment credit

credits are allowed first.

zero to recapture the unused portion of the

(Form 3468) or the biodiesel and

credit.

renewable diesel fuels credit (Form 8864)

If you have an unused credit after

in Part III with box A or B checked.

carrying it back 1 year, carry it forward to

See Form 4255 for any other recapture

You are an estate or trust and the

each of the 20 tax years after the year of

event (change in ownership or change in

source credit must be allocated to

the credit. Any qualified business credits

use of property, etc.).

beneficiaries. For more details, see the

(as defined in section 196(c)) that are

instructions for Form 1041, U.S. Income

Carryforward of certain Form 6478

unused after the last tax year of the

Tax Return for Estates and Trusts,

credits. The alcohol mixture credit, the

20-year carryforward period (or at the time

Schedule K-1, box 13.

alcohol credit, and the small ethanol

an individual taxpayer dies or other

You are a cooperative and the source

producer credit expired for fuels sold or

taxpayer, such as a corporation or

credit can or must be allocated to patrons.

used after 2011. The unused alcohol

partnership, ceases to exist) may be taken

For more details, see the instructions for

mixture credits, alcohol credits, and small

as a deduction in the earlier of:

Form 1120-C, U.S. Income Tax Return for

ethanol producer credits (for all tax years)

The tax year following the last tax year

Cooperative Associations, Schedule J,

can't be carried to a tax year beginning

of the 20-year carryforward period, or

line 5c.

after 2014.

The tax year in which the individual

Change in Filing or Marital

taxpayer dies or other taxpayer ceases to

Who Must File

exist.

Status

You must file Form 3800 to claim any of

Figuring the carryforward if a payroll

Your general business credit is limited to

the general business credits.

tax credit election is made. Qualified

your tax liability. Therefore, if you filed a

small businesses electing to claim a

joint return in a carryback or carryforward

portion of the research credit as a payroll

year and your marital status or filing status

tax credit must adjust the research credit

has changed, you may need to figure your

Dec 01, 2016

Cat. No. 10622Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6