Asset Purchase Agreement

ADVERTISEMENT

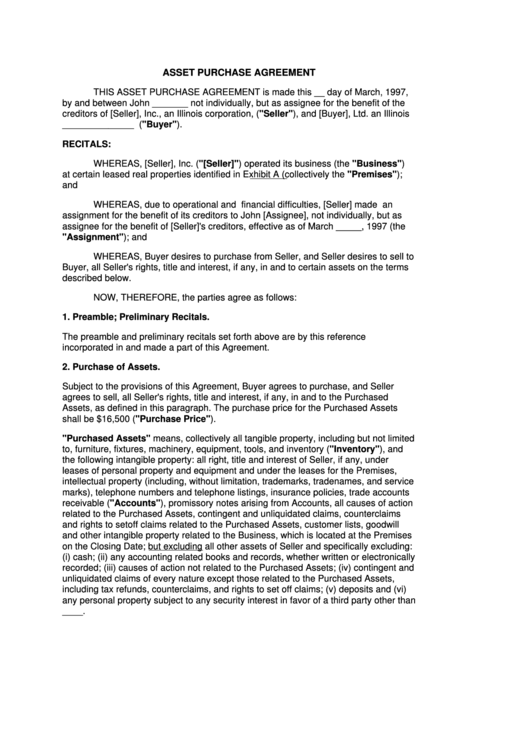

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT is made this __ day of March, 1997,

by and between John _______ not individually, but as assignee for the benefit of the

creditors of [Seller], Inc., an Illinois corporation, ("Seller"), and [Buyer], Ltd. an Illinois

______________ ("Buyer").

RECITALS:

WHEREAS, [Seller], Inc. ("[Seller]") operated its business (the "Business")

at certain leased real properties identified in Exhibit A (collectively the "Premises");

and

WHEREAS, due to operational and financial difficulties, [Seller] made an

assignment for the benefit of its creditors to John [Assignee], not individually, but as

assignee for the benefit of [Seller]'s creditors, effective as of March _____, 1997 (the

"Assignment"); and

WHEREAS, Buyer desires to purchase from Seller, and Seller desires to sell to

Buyer, all Seller's rights, title and interest, if any, in and to certain assets on the terms

described below.

NOW, THEREFORE, the parties agree as follows:

1.

Preamble; Preliminary Recitals.

The preamble and preliminary recitals set forth above are by this reference

incorporated in and made a part of this Agreement.

2.

Purchase of Assets.

Subject to the provisions of this Agreement, Buyer agrees to purchase, and Seller

agrees to sell, all Seller's rights, title and interest, if any, in and to the Purchased

Assets, as defined in this paragraph. The purchase price for the Purchased Assets

shall be $16,500 ("Purchase Price").

"Purchased Assets" means, collectively all tangible property, including but not limited

to, furniture, fixtures, machinery, equipment, tools, and inventory ("Inventory"), and

the following intangible property: all right, title and interest of Seller, if any, under

leases of personal property and equipment and under the leases for the Premises,

intellectual property (including, without limitation, trademarks, tradenames, and service

marks), telephone numbers and telephone listings, insurance policies, trade accounts

receivable ("Accounts"), promissory notes arising from Accounts, all causes of action

related to the Purchased Assets, contingent and unliquidated claims, counterclaims

and rights to setoff claims related to the Purchased Assets, customer lists, goodwill

and other intangible property related to the Business, which is located at the Premises

on the Closing Date; but excluding all other assets of Seller and specifically excluding:

(i) cash; (ii) any accounting related books and records, whether written or electronically

recorded; (iii) causes of action not related to the Purchased Assets; (iv) contingent and

unliquidated claims of every nature except those related to the Purchased Assets,

including tax refunds, counterclaims, and rights to set off claims; (v) deposits and (vi)

any personal property subject to any security interest in favor of a third party other than

____.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8