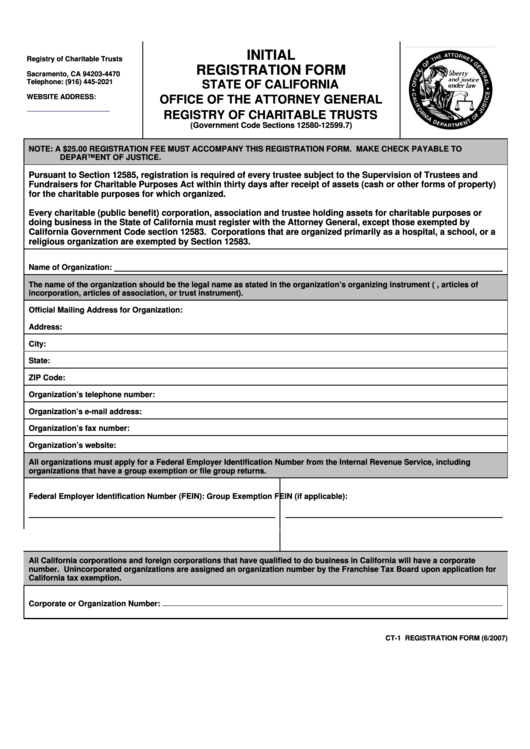

INITIAL

Registry of Charitable Trusts

P.O. Box 903447

REGISTRATION FORM

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

STATE OF CALIFORNIA

WEBSITE ADDRESS:

OFFICE OF THE ATTORNEY GENERAL

REGISTRY OF CHARITABLE TRUSTS

(Government Code Sections 12580-12599.7)

NOTE: A $25.00 REGISTRATION FEE MUST ACCOMPANY THIS REGISTRATION FORM. MAKE CHECK PAYABLE TO

DEPARTMENT OF JUSTICE.

Pursuant to Section 12585, registration is required of every trustee subject to the Supervision of Trustees and

Fundraisers for Charitable Purposes Act within thirty days after receipt of assets (cash or other forms of property)

for the charitable purposes for which organized.

Every charitable (public benefit) corporation, association and trustee holding assets for charitable purposes or

doing business in the State of California must register with the Attorney General, except those exempted by

California Government Code section 12583. Corporations that are organized primarily as a hospital, a school, or a

religious organization are exempted by Section 12583.

Name of Organization:

The name of the organization should be the legal name as stated in the organization’s organizing instrument (i.e., articles of

incorporation, articles of association, or trust instrument).

Official Mailing Address for Organization:

Address:

City:

State:

ZIP Code:

Organization’s telephone number:

Organization’s e-mail address:

Organization’s fax number:

Organization’s website:

All organizations must apply for a Federal Employer Identification Number from the Internal Revenue Service, including

organizations that have a group exemption or file group returns.

Federal Employer Identification Number (FEIN):

Group Exemption FEIN (if applicable):

All California corporations and foreign corporations that have qualified to do business in California will have a corporate

number. Unincorporated organizations are assigned an organization number by the Franchise Tax Board upon application for

California tax exemption.

Corporate or Organization Number:

CT-1 REGISTRATION FORM (6/2007)

1

1 2

2 3

3