Form 1285 V3 - Power Of Attorney

Download a blank fillable Form 1285 V3 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 1285 V3 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

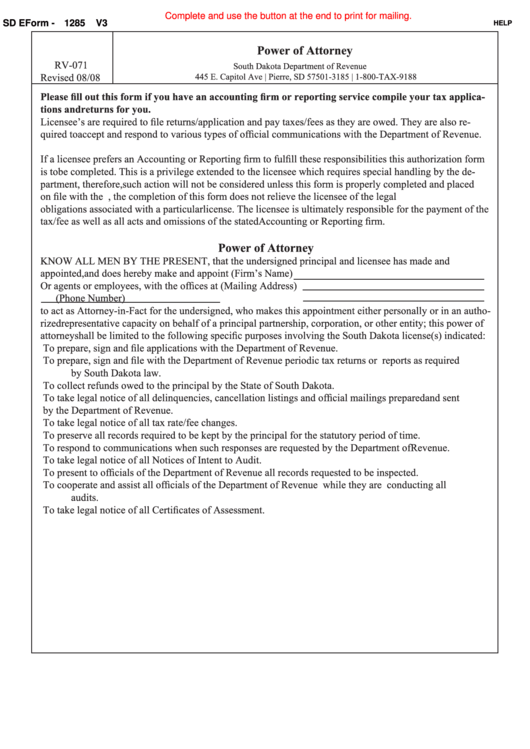

Complete and use the button at the end to print for mailing.

SD EForm - 1285

V3

HELP

Power of Attorney

RV-071

South Dakota Department of Revenue

Revised 08/08

445 E. Capitol Ave | Pierre, SD 57501-3185 | 1-800-TAX-9188

Please fill out this form if you have an accounting firm or reporting service compile your tax applica-

tions andreturns for you.

Licensee’s are required to file returns/application and pay taxes/fees as they are owed. They are also re-

quired to accept and respond to various types of official communications with the Department of Revenue.

If a licensee prefers an Accounting or Reporting firm to fulfill these responsibilities this authorization form

is to be completed. This is a privilege extended to the licensee which requires special handling by the de-

partment, therefore,such action will not be considered unless this form is properly completed and placed

on file with the Department. However, the completion of this form does not relieve the licensee of the legal

obligations associated with a particular license. The licensee is ultimately responsible for the payment of the

tax/fee as well as all acts and omissions of the stated Accounting or Reporting firm.

Power of Attorney

KNOW ALL MEN BY THE PRESENT, that the undersigned principal and licensee has made and

appointed,and does hereby make and appoint (Firm’s Name)

Or agents or employees, with the offices at (Mailing Address)

(Phone Number)

to act as Attorney-in-Fact for the undersigned, who makes this appointment either personally or in an autho-

rized representative capacity on behalf of a principal partnership, corporation, or other entity; this power of

attorney shall be limited to the following specific purposes involving the South Dakota license(s) indicated:

To prepare, sign and file applications with the Department of Revenue.

To prepare, sign and file with the Department of Revenue periodic tax returns or reports as required

by South Dakota law.

To collect refunds owed to the principal by the State of South Dakota.

To take legal notice of all delinquencies, cancellation listings and official mailings prepared and sent

by the Department of Revenue.

To take legal notice of all tax rate/fee changes.

To preserve all records required to be kept by the principal for the statutory period of time.

To respond to communications when such responses are requested by the Department ofRevenue.

To take legal notice of all Notices of Intent to Audit.

To present to officials of the Department of Revenue all records requested to be inspected.

To cooperate and assist all officials of the Department of Revenue while they are conducting all

audits.

To take legal notice of all Certificates of Assessment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2