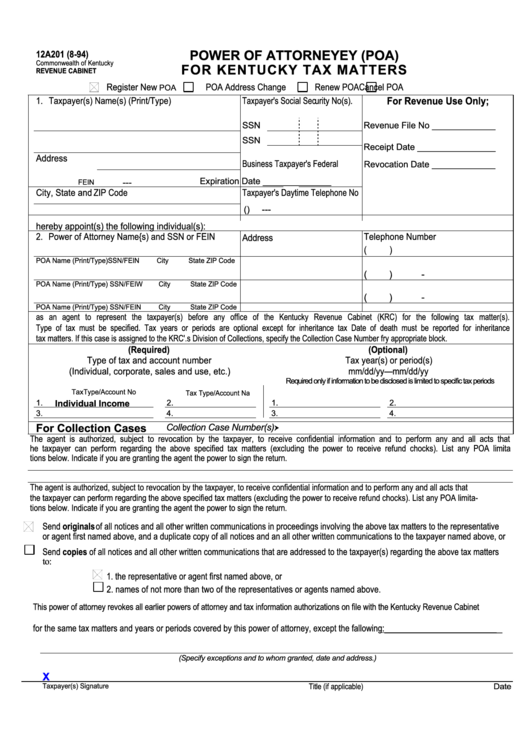

POWER OF ATTORNEYEY (POA)

12A201 (8-94)

Commonwealth of Kentucky

FOR KENTUCKY TAX MATTERS

REVENUE CABINET

Register New

POA Address Change

Renew POA

Cancel POA

POA

1. Taxpayer(s) Name(s) (Print/Type)

Taxpayer's Social Security No(s).

For Revenue Use Only;

SSN

Revenue File No _____________

SSN

Receipt Date ________________

Address

Business Taxpayer's Federal

Revocation Date _____________

Expiration Date ______________

---

FEIN

City, State and ZIP Code

Taxpayer's Daytime Telephone No

(

)

---

hereby appoint(s) the following individual(s):

2. Power of Attorney Name{s) and SSN or FEIN

Telephone Number

Address

0

(

)

POA Name (Print/Type)

SSN/FEIN

City

State

ZIP Code

(

)

-

POA Name (Print/Type)

SSN/FEIW

City

State

ZIP Code

(

)

-

POA Name (Print/Type)

SSN/FEIN

City

State

ZIP Code

as an agent to represent the taxpayer(s) before any office of the Kentucky Revenue Cabinet (KRC) for the following tax matter(s).

Type of tax must be specified. Tax years or periods are optional except for inheritance tax Date of death must be reported for inheritance

tax matters. If this case is assigned to the KRC'.s Division of Collections, specify the Collection Case Number fry appropriate block.

(Required)

(Optional)

Type of tax and account number

Tax year(s) or period(s)

(Individual, corporate, sales and use, etc.)

mm/dd/yy—mm/dd/yy

Required only if information to be disclosed is limited to specific tax periods

TaxType/Account No

Tax Type/Account Na

1.

2.

1.

2.

Individual Income

3.

4.

3.

4.

For Collection Cases

Collection Case Number(s)

The agent is authorized, subject to revocation by the taxpayer, to receive confidential information and to perform any and all acts that

he taxpayer can perform regarding the above specified tax matters (excluding the power to receive refund chocks). List any POA limita

tions below. Indicate if you are granting the agent the power to sign the return.

The agent is authorized, subject to revocation by the taxpayer, to receive confidential information and to perform any and all acts that

the taxpayer can perform regarding the above specified tax matters (excluding the power to receive refund chocks). List any POA limita-

tions below. Indicate if you are granting the agent the power to sign the return.

Send originals of all notices and all other written communications in proceedings involving the above tax matters to the representative

or agent first named above, and a duplicate copy of all notices and an all other written communications to the taxpayer named above, or

Send copies of all notices and all other written communications that are addressed to the taxpayer(s) regarding the above tax matters

to:

1. the representative or agent first named above, or

2. names of not more than two of the representatives or agents named above.

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the Kentucky Revenue Cabinet

for the same tax matters and years or periods covered by this power of attorney, except the fallowing:___________________________

(Specify exceptions and to whom granted, date and address.)

X

Taxpayer(s) Signature

Title (if applicable)

Date

1

1