Instructions For Form 1099-B - 2017

ADVERTISEMENT

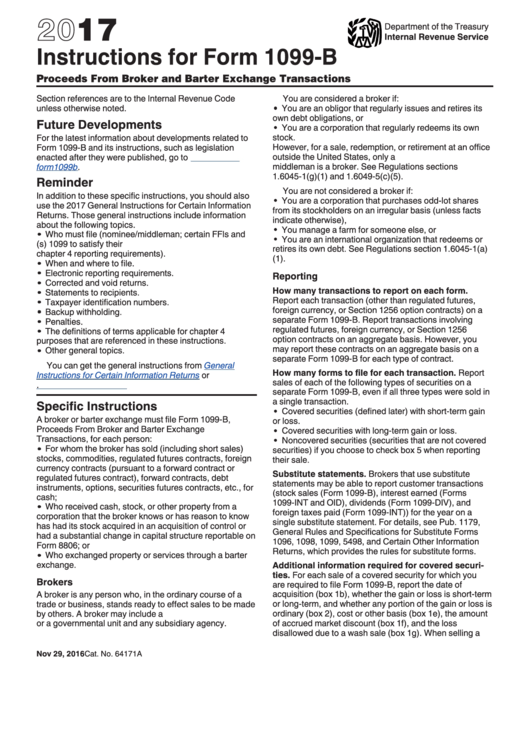

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 1099-B

Proceeds From Broker and Barter Exchange Transactions

Section references are to the Internal Revenue Code

You are considered a broker if:

unless otherwise noted.

You are an obligor that regularly issues and retires its

own debt obligations, or

Future Developments

You are a corporation that regularly redeems its own

stock.

For the latest information about developments related to

However, for a sale, redemption, or retirement at an office

Form 1099-B and its instructions, such as legislation

outside the United States, only a U.S. payer or U.S.

enacted after they were published, go to

middleman is a broker. See Regulations sections

form1099b.

1.6045-1(g)(1) and 1.6049-5(c)(5).

Reminder

You are not considered a broker if:

In addition to these specific instructions, you should also

You are a corporation that purchases odd-lot shares

use the 2017 General Instructions for Certain Information

from its stockholders on an irregular basis (unless facts

Returns. Those general instructions include information

indicate otherwise),

about the following topics.

You manage a farm for someone else, or

Who must file (nominee/middleman; certain FFIs and

You are an international organization that redeems or

U.S. payers that report on Form(s) 1099 to satisfy their

retires its own debt. See Regulations section 1.6045-1(a)

chapter 4 reporting requirements).

(1).

When and where to file.

Electronic reporting requirements.

Reporting

Corrected and void returns.

How many transactions to report on each form.

Statements to recipients.

Report each transaction (other than regulated futures,

Taxpayer identification numbers.

foreign currency, or Section 1256 option contracts) on a

Backup withholding.

separate Form 1099-B. Report transactions involving

Penalties.

regulated futures, foreign currency, or Section 1256

The definitions of terms applicable for chapter 4

option contracts on an aggregate basis. However, you

purposes that are referenced in these instructions.

may report these contracts on an aggregate basis on a

Other general topics.

separate Form 1099-B for each type of contract.

You can get the general instructions from

General

How many forms to file for each transaction. Report

Instructions for Certain Information Returns

or

sales of each of the following types of securities on a

form1099b.

separate Form 1099-B, even if all three types were sold in

a single transaction.

Specific Instructions

Covered securities (defined later) with short-term gain

A broker or barter exchange must file Form 1099-B,

or loss.

Proceeds From Broker and Barter Exchange

Covered securities with long-term gain or loss.

Transactions, for each person:

Noncovered securities (securities that are not covered

For whom the broker has sold (including short sales)

securities) if you choose to check box 5 when reporting

stocks, commodities, regulated futures contracts, foreign

their sale.

currency contracts (pursuant to a forward contract or

Substitute statements. Brokers that use substitute

regulated futures contract), forward contracts, debt

statements may be able to report customer transactions

instruments, options, securities futures contracts, etc., for

(stock sales (Form 1099-B), interest earned (Forms

cash;

1099-INT and OID), dividends (Form 1099-DIV), and

Who received cash, stock, or other property from a

foreign taxes paid (Form 1099-INT)) for the year on a

corporation that the broker knows or has reason to know

single substitute statement. For details, see Pub. 1179,

has had its stock acquired in an acquisition of control or

General Rules and Specifications for Substitute Forms

had a substantial change in capital structure reportable on

1096, 1098, 1099, 5498, and Certain Other Information

Form 8806; or

Returns, which provides the rules for substitute forms.

Who exchanged property or services through a barter

exchange.

Additional information required for covered securi-

ties. For each sale of a covered security for which you

Brokers

are required to file Form 1099-B, report the date of

A broker is any person who, in the ordinary course of a

acquisition (box 1b), whether the gain or loss is short-term

trade or business, stands ready to effect sales to be made

or long-term, and whether any portion of the gain or loss is

by others. A broker may include a U.S. or foreign person

ordinary (box 2), cost or other basis (box 1e), the amount

or a governmental unit and any subsidiary agency.

of accrued market discount (box 1f), and the loss

disallowed due to a wash sale (box 1g). When selling a

Nov 29, 2016

Cat. No. 64171A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11