Instructions For Form 1120-Sf - U.s. Income Tax Return For Settlement Funds - 2016

ADVERTISEMENT

Instructions for

Department of the Treasury

Internal Revenue Service

Form 1120-SF

(Rev. December 2016)

U.S. Income Tax Return for Settlement Funds

the tax due or $205. See Late filing of

ending in June will be treated as if the

Section references are to the Internal Revenue

Code unless otherwise noted.

return, later.

short year ended on June 30, and must file

by the 15th day of the 3rd month after the

Future Developments

General Instructions

end of its tax year.

If the due date falls on a Saturday,

For the latest information about

Purpose of Form

Sunday, or legal holiday, the fund may file

developments related to Form 1120-SF

on the next business day.

and its instructions, such as legislation

Use Form 1120-SF to report transfers

enacted after they were published, go to

received, income earned, deductions

Private delivery services. Settlement

funds can use certain private delivery

claimed, distributions made, and to figure

services designated by the IRS to meet

the income tax liability of a designated or

What's New

qualified settlement fund.

the timely mailing as “timely filing/paying”

rule for tax returns and payments. See the

Change in due date for filing settle-

Who Must File

Instructions for Form 1120, U.S.

ment fund returns. For tax years

Corporation Income Tax Return, for

beginning after 2015, the due date for

All section 468B designated and qualified

details.

filing settlement fund returns generally is

settlement funds must file an annual

the 15th day of the 4th month after the end

income tax return on Form 1120-SF.

Private delivery services cannot

of the fund’s tax year. Special rules apply

deliver items to P.O. boxes. The

!

When To File

for funds with tax years ending in June.

fund must use the U.S. Postal

CAUTION

See When To File, later.

Service to mail any items to an IRS P.O.

Generally, a settlement fund must file its

box address.

income tax return by the 15th day of the

Increase in penalty for failure to file.

4th month after the end of its tax year.

For returns required to be filed after

Extension of time to file. File Form

December 31, 2015, the minimum penalty

However, a fund with a fiscal tax year

7004, Application for Automatic Extension

for failure to file a return that is over 60

ending on June 30 must file by the 15th

of Time To File Certain Business Income

days late has increased to the smaller of

day of the 3rd month after the end of its

Tax, Information, and Other Returns, to

tax year. A fund with a short tax year

request an extension of time to file.

Generally, file Form 7004 by the regular

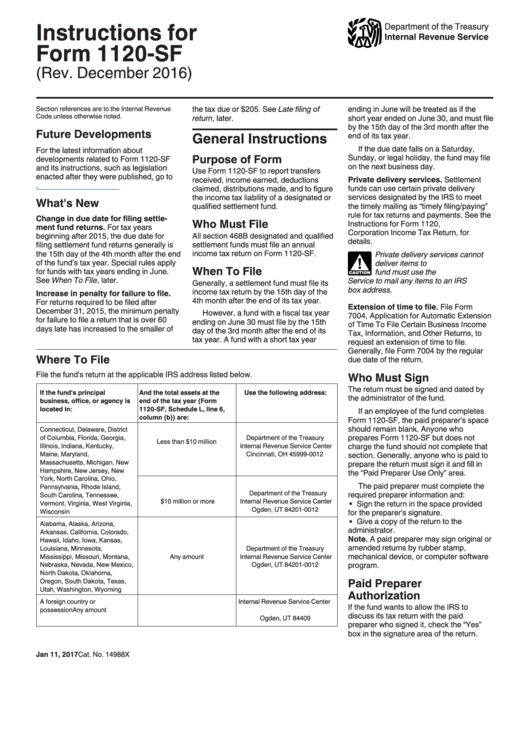

Where To File

due date of the return.

File the fund's return at the applicable IRS address listed below.

Who Must Sign

The return must be signed and dated by

If the fund's principal

And the total assets at the

Use the following address:

the administrator of the fund.

business, office, or agency is

end of the tax year (Form

located in:

1120-SF, Schedule L, line 6,

If an employee of the fund completes

column (b)) are:

Form 1120-SF, the paid preparer's space

should remain blank. Anyone who

Connecticut, Delaware, District

prepares Form 1120-SF but does not

of Columbia, Florida, Georgia,

Department of the Treasury

Less than $10 million

charge the fund should not complete that

Illinois, Indiana, Kentucky,

Internal Revenue Service Center

Maine, Maryland,

Cincinnati, OH 45999-0012

section. Generally, anyone who is paid to

Massachusetts, Michigan, New

prepare the return must sign it and fill in

Hampshire, New Jersey, New

the “Paid Preparer Use Only” area.

York, North Carolina, Ohio,

The paid preparer must complete the

Pennsylvania, Rhode Island,

Department of the Treasury

required preparer information and:

South Carolina, Tennessee,

$10 million or more

Internal Revenue Service Center

Sign the return in the space provided

Vermont, Virginia, West Virginia,

Ogden, UT 84201-0012

for the preparer's signature.

Wisconsin

Give a copy of the return to the

Alabama, Alaska, Arizona,

administrator.

Arkansas, California, Colorado,

Note. A paid preparer may sign original or

Hawaii, Idaho, Iowa, Kansas,

amended returns by rubber stamp,

Louisiana, Minnesota,

Department of the Treasury

mechanical device, or computer software

Mississippi, Missouri, Montana,

Any amount

Internal Revenue Service Center

program.

Nebraska, Nevada, New Mexico,

Ogden, UT 84201-0012

North Dakota, Oklahoma,

Paid Preparer

Oregon, South Dakota, Texas,

Utah, Washington, Wyoming

Authorization

A foreign country or U.S.

Internal Revenue Service Center

If the fund wants to allow the IRS to

possession

Any amount

P.O. Box 409101

discuss its tax return with the paid

Ogden, UT 84409

preparer who signed it, check the “Yes”

box in the signature area of the return.

Jan 11, 2017

Cat. No. 14988X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5