Employee Time Sheet Instructions

ADVERTISEMENT

TIMESHEETS

Timesheets are distributed to employees by the departmental payroll processor.

Faculty, A&P and exempt USPS employees are not required to complete a Timesheet.

All non-exempt USPS and hourly OPS employees must complete a Timesheet each biweekly pay

period. The Timesheet must accurately reflect the hours the employees worked during Week 1

and Week 2 of the pay period. Total hours worked each day must be rounded to the nearest

quarter hour (15 minutes) and indicated in the “Total Hrs” column. The “Total Hours Worked”

column for each week should reflect the total number of hours worked during the workweek.

The Timesheet must be signed by the supervisor; however, if the employee is unavailable to the

sign the Timesheet, the supervisor may indicate such on the employee’s signature line.

If an employee does not complete a Timesheet and/or Leave and Pay Exception Report, it

becomes the responsibility of the supervisor to complete one and submit it for processing and

approval.

When a non-exempt USPS employee uses any type of leave or leave without pay, he/she must

submit a Leave and Pay Exceptions Report, in addition to the Timesheet.

When a non-exempt USPS employee works more than his/her scheduled hours during a

workweek, he/she must submit a Leave and Pay Exceptions Report, in addition to the

Timesheet.

Non-Exempt USPS Employees

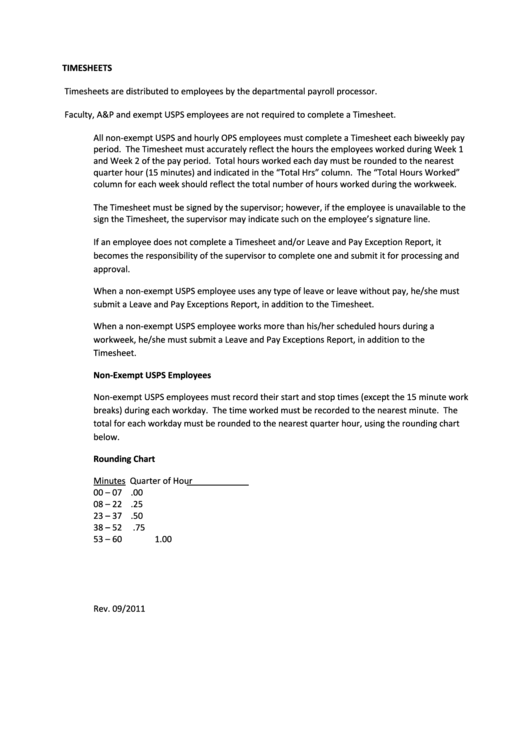

Non-exempt USPS employees must record their start and stop times (except the 15 minute work

breaks) during each workday. The time worked must be recorded to the nearest minute. The

total for each workday must be rounded to the nearest quarter hour, using the rounding chart

below.

Rounding Chart

Minutes

Quarter of Hour

00 – 07

.00

08 – 22

.25

23 – 37

.50

38 – 52

.75

53 – 60

1.00

Rev. 09/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1