Instructions For Forms 1099-A And 1099-C - 2017

ADVERTISEMENT

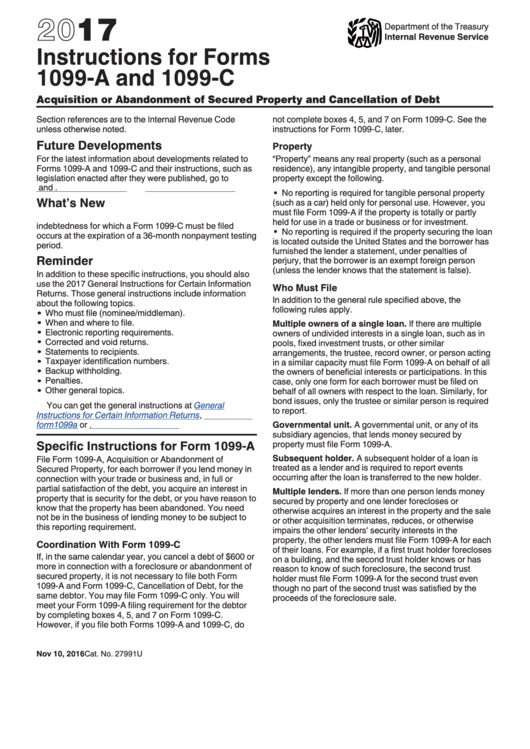

2017

Department of the Treasury

Internal Revenue Service

Instructions for Forms

1099-A and 1099-C

Acquisition or Abandonment of Secured Property and Cancellation of Debt

Section references are to the Internal Revenue Code

not complete boxes 4, 5, and 7 on Form 1099-C. See the

unless otherwise noted.

instructions for Form 1099-C, later.

Future Developments

Property

For the latest information about developments related to

“Property” means any real property (such as a personal

Forms 1099-A and 1099-C and their instructions, such as

residence), any intangible property, and tangible personal

legislation enacted after they were published, go to

property except the following.

and

No reporting is required for tangible personal property

What’s New

(such as a car) held only for personal use. However, you

must file Form 1099-A if the property is totally or partly

T.D. 9793 removes the rule that a deemed discharge of

held for use in a trade or business or for investment.

indebtedness for which a Form 1099-C must be filed

No reporting is required if the property securing the loan

occurs at the expiration of a 36-month nonpayment testing

is located outside the United States and the borrower has

period.

furnished the lender a statement, under penalties of

Reminder

perjury, that the borrower is an exempt foreign person

(unless the lender knows that the statement is false).

In addition to these specific instructions, you should also

use the 2017 General Instructions for Certain Information

Who Must File

Returns. Those general instructions include information

In addition to the general rule specified above, the

about the following topics.

following rules apply.

Who must file (nominee/middleman).

When and where to file.

Multiple owners of a single loan. If there are multiple

Electronic reporting requirements.

owners of undivided interests in a single loan, such as in

Corrected and void returns.

pools, fixed investment trusts, or other similar

Statements to recipients.

arrangements, the trustee, record owner, or person acting

Taxpayer identification numbers.

in a similar capacity must file Form 1099-A on behalf of all

Backup withholding.

the owners of beneficial interests or participations. In this

Penalties.

case, only one form for each borrower must be filed on

Other general topics.

behalf of all owners with respect to the loan. Similarly, for

bond issues, only the trustee or similar person is required

You can get the general instructions at

General

to report.

Instructions for Certain Information

Returns,

form1099a

or

Governmental unit. A governmental unit, or any of its

subsidiary agencies, that lends money secured by

Specific Instructions for Form 1099-A

property must file Form 1099-A.

Subsequent holder. A subsequent holder of a loan is

File Form 1099-A, Acquisition or Abandonment of

treated as a lender and is required to report events

Secured Property, for each borrower if you lend money in

occurring after the loan is transferred to the new holder.

connection with your trade or business and, in full or

partial satisfaction of the debt, you acquire an interest in

Multiple lenders. If more than one person lends money

property that is security for the debt, or you have reason to

secured by property and one lender forecloses or

know that the property has been abandoned. You need

otherwise acquires an interest in the property and the sale

not be in the business of lending money to be subject to

or other acquisition terminates, reduces, or otherwise

this reporting requirement.

impairs the other lenders' security interests in the

property, the other lenders must file Form 1099-A for each

Coordination With Form 1099-C

of their loans. For example, if a first trust holder forecloses

If, in the same calendar year, you cancel a debt of $600 or

on a building, and the second trust holder knows or has

more in connection with a foreclosure or abandonment of

reason to know of such foreclosure, the second trust

secured property, it is not necessary to file both Form

holder must file Form 1099-A for the second trust even

1099-A and Form 1099-C, Cancellation of Debt, for the

though no part of the second trust was satisfied by the

same debtor. You may file Form 1099-C only. You will

proceeds of the foreclosure sale.

meet your Form 1099-A filing requirement for the debtor

by completing boxes 4, 5, and 7 on Form 1099-C.

However, if you file both Forms 1099-A and 1099-C, do

Nov 10, 2016

Cat. No. 27991U

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6