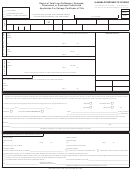

SALES TAX INSTRUCTIONS

A)

SALES OR USE TAX COMPUTATION - The sales or use tax is based on the invoiced purchase price for vehicles purchased from a licensed dealer. If

the vehicle is purchased from a private individual, not from a licensed dealer, the sales or use tax is based on the current month's issue of the N.A.D.A.

Official Used Car Guide, Eastern Edition or the Bill of Sale, whichever is greater.

SALES TAX PAID IN ANOTHER STATE - In order to obtain credit for sales/use tax paid to another jurisdiction, you must present proof of payment in

B)

the form of an official receipt or dealer's invoice.

C)

BARTER, TRADE, SWAP - When two individuals trade vehicles, each must pay sales/use tax on the value of the vehicle received based on the current

month's issue of the N.A.D.A. Official Used Car Guide, Eastern Edition.

D)

CHECKS - Please make your check payable to "DMV". The total for all DMV fees also will include the sales tax.

E)

REFUNDS - Claims for sales or use tax refunds must be submitted to the Department of Revenue Services. Use CERT-106, Claim for Refund of Use

Tax Paid on Motor Vehicle Purchased fromOther Than a Motor Vehicle Dealer, to claim a refund of use tax paid on a motor vehicle purchased from

other than a motor vehicle dealer. A CERT-106 form is available at all DMV branches. All other claims for refund, with supporting documents, must be

directed to the Department of Revenue Services, Refunds, Clearance and Adjustments Unit, 25 Sigourney Street, Hartford, CT 06106.

SPECIAL INSTRUCTIONS FOR THOSE CLAIMING EXEMPTION FROM CONNECTICUT SALES OR USE TAX

Specify the applicable code (1, 2, 3, 4, or 5) as described below in the space on the front in SECTION 1 labeled IF TAX EXEMPTION IS CLAIMED. Include

additional information as required below for the applicable code in the area labeled EXEMPTION INFORMATION.

Code 1:

Transfer between immediate family members (Only MOTHER, FATHER, SPOUSE (wife, husband, civil union), DAUGHTER, SON,

SISTER or BROTHER qualify as "immediate family members"). Specify code "1" and in the area labeled EXEMPTION INFORMATION,

write which of the above-listed relationships describes the person from whom you obtained the vehicle. Specify the state in which this

immediate family member previously registered the vehicle. In order to qualify for this exemption, the vehicle must have been registered in

this immediate family member's name for at least 60 days.

Sale to a Connecticut exempt organization or to a governmental agency. Specify code "2" and write the Connecticut Tax Exemption

Code 2:

Number beginning with "E" in the area labeled EXEMPTION INFORMATION or attach a copy of the organization's Internal Revenue Code

Section 501(c)(3) or 501(c)(13) exemption letter issued by the IRS.

Code 3:

Sales or Use Tax was paid to another jurisdiction. An official receipt or dealer's invoice must be presented identifying the amount of

sales tax paid. Specify code "3" and, in the area labeled EXEMPTION INFORMATION, write the amount of tax paid and the jurisdiction to

which this tax was paid.

Code 4:

Vehicles purchased while residing outside of Connecticut. Out-of-state registration or photocopy is required. Vehicles should have

been registered out-of-state at least 30 days prior to application for Connecticut registration. Specify code "4" and, in the area labeled

EXEMPTION INFORMATION, write in order (1) the state in which you were residing when you purchased vehicle, (2) the date the vehicle

was purchased, (3) the date the vehicle was registered in that state, and (4) the date the vehicle was first moved to Connecticut.

Code 5:

Other reasons. Specify code "5" and write the applicable letter from the list below in the area labeled EXEMPTION INFORMATION.

5A)

GIFT - If vehicle was received as a gift, provide a copy of form AU-463, "Motor Vehicle and Vessel Gift Declaration". These forms

are available at all DMV offices.

5B)

VEHICLE PURCHASED BY A LESSOR EXCLUSIVELY FOR LEASE OR RENTAL - Provide the Connecticut Tax Registration

Number of the lessor/purchaser.

5C)

SALE BY A FEDERAL AGENCY, FEDERAL CREDIT UNION OR AMERICAN RED CROSS - Vehicle must have been obtained

from a Federal Agency, a Federal Credit Union or the American Red Cross.

5D)

CORPORATE ORGANIZATION, REORGANIZATION OR LIQUIDATION - Acquiring a vehicle in connection with the organization,

reorganization or liquidation of an incorporated business provided (a) the last taxable sale, transfer or use of the motor vehicle was

subjected to Connecticut sales or use tax, (b) the transferee is the incorporated business or a stockholder thereof.

5E)

PARTNERSHIP OR LLC ORGANIZATION OR TERMINATION - Acquiring a vehicle in connection with the organization or

termination of a partnership or LLC provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to

Connecticut sales or use tax, and (b) the purchaser is the partnership or limited liability company, as the case may be, or a partner

or member, thereof, as the case may be.

5F)

HIGH MPG PASSENGER MOTOR VEHICLES - Section 12-412(110) exempts the sale on and after January 1, 2008, and prior to

July 1, 2010, of any passenger motor vehicle, as defined in section 14-1, that has a U.S. EPA estimated city or highway gasoline

mileage rating of at least 40 miles per gallon.

5G)

COMMERCIAL TRUCKS, TRUCK TRACTORS, TRACTORS AND SEMITRAILERS AND VEHICLES USED IN COMBINATION

THEREWITH - Section 12-412(70)(A)(i) exempts commercial trucks, truck tractors, tractors and semitrailers and vehicles used in

combination therewith which have a gross vehicle weight rating in excess of 26,000 pounds.

Section 12-412(70)(A)(ii) exempts commercial trucks, truck tractors, tractors and semitrailers and vehicles used in combination

therewith operated actively and exclusively during the period commencing upon its purchase and ending one year after the date of

purchase for the carriage of interstate freight pursuant to a certificate or permit issued by the Interstate Commerce Commission

(ICC) or its successor agency. Purchaser - please attach a copy of your certificate or permit that was issued by the ICC or its

successor agency, and a copy of a properly completed Dept. of Revenue Services CERT-105, Commercial Motor Vehicle

Purchased Within Connecticut for Use in the Carriage of Freight in Interstate Commerce.

For further information about sales and use taxes, see the DRS website ( ) or call DRS during business hours, Monday through Friday:

•

1-800-382-9463 (Connecticut calls outside the Greater Hartford calling area only); or

•

860-297-5962 (from anywhere).

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling 860-297-4911.

1

1 2

2