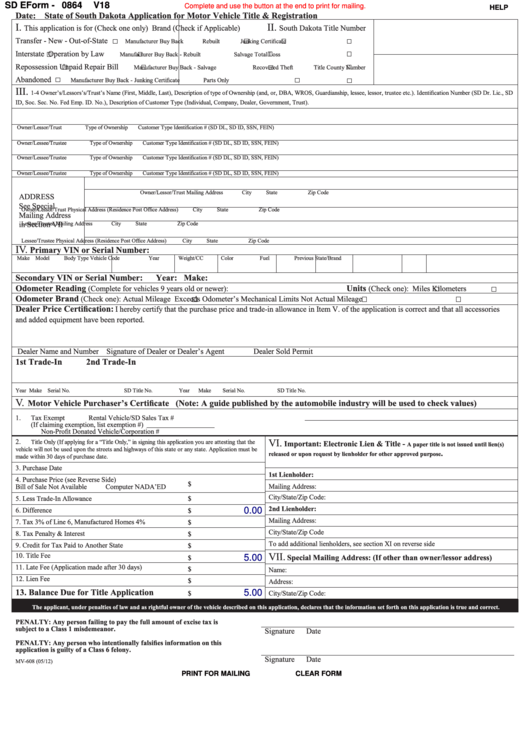

SD EForm - 0864

V18

Complete and use the button at the end to print for mailing.

HELP

Date:

State of South Dakota Application for Motor Vehicle Title & Registration

I.

II.

This application is for (Check one only)

Brand (Check if Applicable)

South Dakota Title Number

Transfer - New - Out-of-State

Manufacturer Buy Back

Rebuilt

Junking Certificate

Interstate

Operation by Law

Manufacturer Buy Back - Rebuilt

Salvage Total Loss

Repossession

Unpaid Repair Bill

Manufacturer Buy Back - Salvage

Recovered Theft

Title County Number

Abandoned

Manufacturer Buy Back - Junking Certificate

Parts Only

III.

1-4 Owner’s/Lessors’s/Trust’s Name (First, Middle, Last), Description of type of Ownership (and, or, DBA, WROS, Guardianship, lessee, lessor, trustee etc.). Identification Number (SD Dr. Lic., SD

ID, Soc. Sec. No. Fed Emp. ID. No.), Description of Customer Type (Individual, Company, Dealer, Government, Trust).

Owner/Lessor/Trust

Type of Ownership

Customer Type

Identification # (SD DL, SD ID, SSN, FEIN)

Owner/Lessee/Trustee

Type of Ownership

Customer Type

Identification # (SD DL, SD ID, SSN, FEIN)

Owner/Lessee/Trustee

Type of Ownership

Customer Type

Identification # (SD DL, SD ID, SSN, FEIN)

Owner/Lessee/Trustee

Type of Ownership

Customer Type

Identification # (SD DL, SD ID, SSN, FEIN)

Owner/Lessor/Trust Mailing Address

City

State

Zip Code

ADDRESS

See Special

Owner/Lessor/Trust Physical Address (Residence Post Office Address)

City

State

Zip Code

Mailing Address

in Section VII

Lessee/Trustee Mailing Address

City

State

Zip Code

Lessee/Trustee Physical Address (Residence Post Office Address)

City

State

Zip Code

IV.

Primary VIN or Serial Number:

Make

Model

Body Type

Vehicle Code

Year

Weight/CC

Color

Fuel

Previous State/Brand

Secondary VIN or Serial Number:

Year:

Make:

Odometer Reading

Units

(Complete for vehicles 9 years old or newer):

(Check one): Miles

Kilometers

Odometer Brand

(Check one):

Actual Mileage

Exceeds Odometer’s Mechanical Limits

Not Actual Mileage

Dealer Price Certification:

I hereby certify that the purchase price and trade-in allowance in Item V. of the application is correct and that all accessories

and added equipment have been reported.

Dealer Name and Number

Signature of Dealer or Dealer’s Agent

Dealer Sold Permit

1st Trade-In

2nd Trade-In

Year

Make

Serial No.

SD Title No.

Year

Make

Serial No.

SD Title No.

V.

Motor Vehicle Purchaser’s Certificate

(Note: A guide published by the automobile industry will be used to check values)

1.

Tax Exempt

Rental Vehicle/SD Sales Tax #

(If claiming exemption, list exemption #)

Non-Profit Donated Vehicle/Corporation #

VI.

2.

Title Only (If applying for a “Title Only,” in signing this application you are attesting that the

Important: Electronic Lien & Title -

A paper title is not issued until lien(s)

vehicle will not be used upon the streets and highways of this state or any state. Application must be

.

released or upon request by lienholder for other approved purpose

made within 30 days of purchase date.

3. Purchase Date

1st Lienholder:

4. Purchase Price (see Reverse Side)

Bill of Sale Not Available

Computer NADA’ED

$

Mailing Address:

City/State/Zip Code:

5. Less Trade-In Allowance

$

2nd Lienholder:

6. Difference

0.00

$

Mailing Address:

7. Tax 3% of Line 6, Manufactured Homes 4%

$

City/State/Zip Code

8. Tax Penalty & Interest

$

To add additional lienholders, see section XI on reverse side

9. Credit for Tax Paid to Another State

$

VII.

10. Title Fee

Special Mailing Address: (If other than owner/lessor address)

5.00

$

11. Late Fee (Application made after 30 days)

Name:

$

12. Lien Fee

Address:

$

13. Balance Due for Title Application

City/State/Zip Code:

5.00

$

The applicant, under penalties of law and as rightful owner of the vehicle described on this application, declares that the information set forth on this application is true and correct.

PENALTY: Any person failing to pay the full amount of excise tax is

subject to a Class 1 misdemeanor.

Signature

Date

PENALTY: Any person who intentionally falsifies information on this

application is guilty of a Class 6 felony.

Signature

Date

MV-608 (05/12)

PRINT FOR MAILING

CLEAR FORM

1

1 2

2