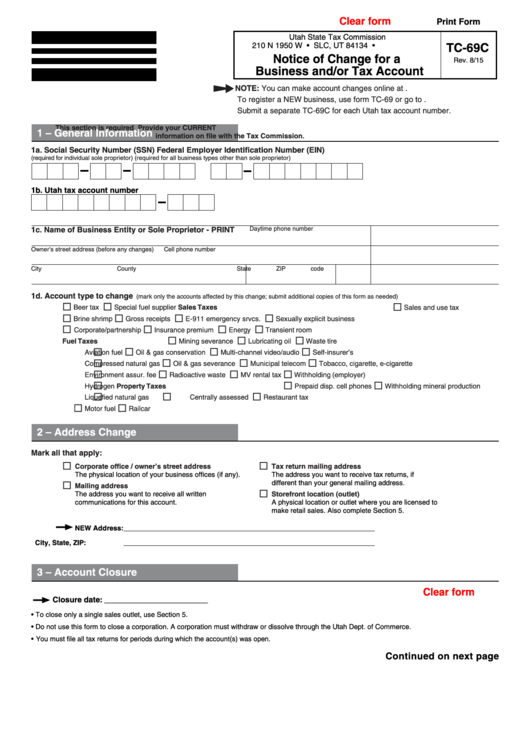

Clear form

Print Form

Utah State Tax Commission

210 N 1950 W • SLC, UT 84134 • tax.utah.gov

TC-69C

Notice of Change for a

Rev. 8/15

Business and/or Tax Account

NOTE: You can make account changes online at taxexpress.utah.gov.

To register a NEW business, use form TC-69 or go to osbr.utah.gov.

Submit a separate TC-69C for each Utah tax account number.

This section is required. Provide your CURRENT

1 – General Information

information on file with the Tax Commission.

1a. Social Security Number (SSN)

Federal Employer Identification Number (EIN)

(required for individual sole proprietor)

(required for all business types other than sole proprietor)

1b. Utah tax account number

Daytime phone number

1c. Name of Business Entity or Sole Proprietor - PRINT

Owner's street address (before any changes)

Cell phone number

City

County

State

ZIP code

1d. Account type to change

(mark only the accounts affected by this change; submit additional copies of this form as needed)

Beer tax

Special fuel supplier

Sales Taxes

Sales and use tax

Brine shrimp

Gross receipts

E-911 emergency srvcs.

Sexually explicit business

Corporate/partnership

Insurance premium

Energy

Transient room

Fuel Taxes

Mining severance

Lubricating oil

Waste tire

Aviation fuel

Oil & gas conservation

Multi-channel video/audio

Self-insurer’s

Compressed natural gas

Oil & gas severance

Municipal telecom

Tobacco, cigarette, e-cigarette

Environment assur. fee

Radioactive waste

MV rental tax

Withholding (employer)

Hydrogen

Property Taxes

Prepaid disp. cell phones

Withholding mineral production

Liquefied natural gas

Centrally assessed

Restaurant tax

Motor fuel

Railcar

2 – Address Change

Mark all that apply:

Corporate office / owner’s street address

Tax return mailing address

The physical location of your business offices (if any).

The address you want to receive tax returns, if

different than your general mailing address.

Mailing address

The address you want to receive all written

Storefront location (outlet)

communications for this account.

A physical location or outlet where you are licensed to

make retail sales. Also complete Section 5.

N EW Address: _ _ _ _ _ _ __ _ _ _ __ _ _ __ __ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

City, State, ZIP: _ _ _ _ _ __ _ _ _ __ _ _ _ __ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3 – Account Closure

Clear form

Closure date:

_ _ _ _ _ _ _ _ __ _ _ _ __ _

• To close only a single sales outlet, use Section 5.

• Do not use this form to close a corporation. A corporation must withdraw or dissolve through the Utah Dept. of Commerce.

• You must file all tax returns for periods during which the account(s) was open.

Continued on next page

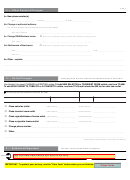

1

1 2

2 3

3