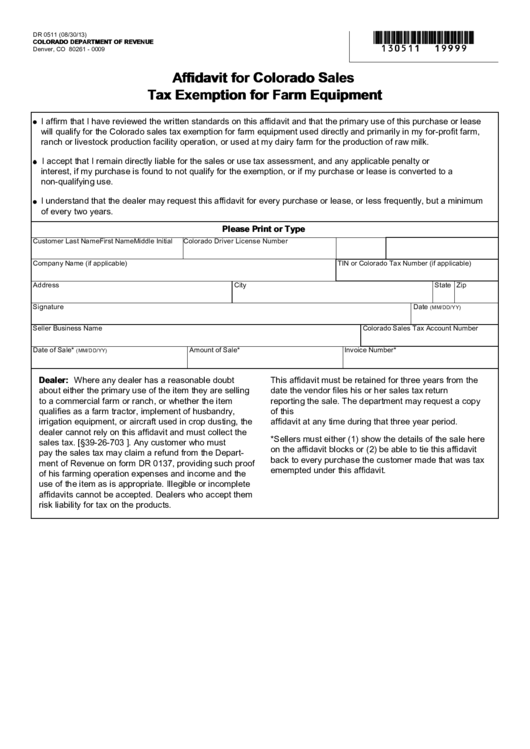

DR 0511 (08/30/13)

*130511==19999*

colorado department of revenue

Denver, CO 80261 - 0009

Affidavit for Colorado Sales

Tax Exemption for Farm Equipment

I affirm that I have reviewed the written standards on this affidavit and that the primary use of this purchase or lease

will qualify for the Colorado sales tax exemption for farm equipment used directly and primarily in my for-profit farm,

ranch or livestock production facility operation, or used at my dairy farm for the production of raw milk.

I accept that I remain directly liable for the sales or use tax assessment, and any applicable penalty or

interest, if my purchase is found to not qualify for the exemption, or if my purchase or lease is converted to a

non-qualifying use.

I understand that the dealer may request this affidavit for every purchase or lease, or less frequently, but a minimum

of every two years.

Please Print or Type

Customer Last Name

First Name

Middle Initial

Colorado Driver License Number

Company Name (if applicable)

TIN or Colorado Tax Number (if applicable)

Address

City

State Zip

Signature

Date

(MM/DD/YY)

Seller Business Name

Colorado Sales Tax Account Number

Date of Sale*

Amount of Sale*

Invoice Number*

(MM/DD/YY)

Dealer: Where any dealer has a reasonable doubt

This affidavit must be retained for three years from the

about either the primary use of the item they are selling

date the vendor files his or her sales tax return

to a commercial farm or ranch, or whether the item

reporting the sale. The department may request a copy

qualifies as a farm tractor, implement of husbandry,

of this

irrigation equipment, or aircraft used in crop dusting, the

affidavit at any time during that three year period.

dealer cannot rely on this affidavit and must collect the

*Sellers must either (1) show the details of the sale here

sales tax. [§39-26-703 C.R.S.]. Any customer who must

on the affidavit blocks or (2) be able to tie this affidavit

pay the sales tax may claim a refund from the Depart-

back to every purchase the customer made that was tax

ment of Revenue on form DR 0137, providing such proof

emempted under this affidavit.

of his farming operation expenses and income and the

use of the item as is appropriate. Illegible or incomplete

affidavits cannot be accepted. Dealers who accept them

risk liability for tax on the products.

1

1