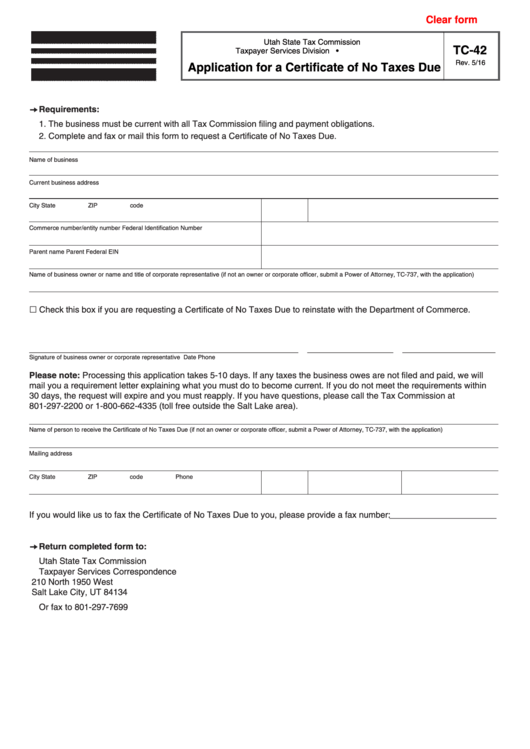

Clear form

Utah State Tax Commission

TC-42

Taxpayer Services Division • tax.utah.gov

Rev. 5/16

Application for a Certificate of No Taxes Due

Requirements:

1. The business must be current with all Tax Commission filing and payment obligations.

2. Complete and fax or mail this form to request a Certificate of No Taxes Due.

Name of business

Current business address

City

State

ZIP code

Commerce number/entity number

Federal Identification Number

Parent name

Parent Federal EIN

Name of business owner or name and title of corporate representative (if not an owner or corporate officer, submit a Power of Attorney, TC-737, with the application)

Check this box if you are requesting a Certificate of No Taxes Due to reinstate with the Department of Commerce.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Signature of business owner or corporate representative

Date

Phone

Please note: Processing this application takes 5-10 days. If any taxes the business owes are not filed and paid, we will

mail you a requirement letter explaining what you must do to become current. If you do not meet the requirements within

30 days, the request will expire and you must reapply. If you have questions, please call the Tax Commission at

801-297-2200 or 1-800-662-4335 (toll free outside the Salt Lake area).

Name of person to receive the Certificate of No Taxes Due (if not an owner or corporate officer, submit a Power of Attorney, TC-737, with the application)

Mailing address

City

State

ZIP code

Phone

If you would like us to fax the Certificate of No Taxes Due to you, please provide a fax number:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Return completed form to:

Utah State Tax Commission

Taxpayer Services Correspondence

210 North 1950 West

Salt Lake City, UT 84134

Or fax to 801-297-7699

1

1