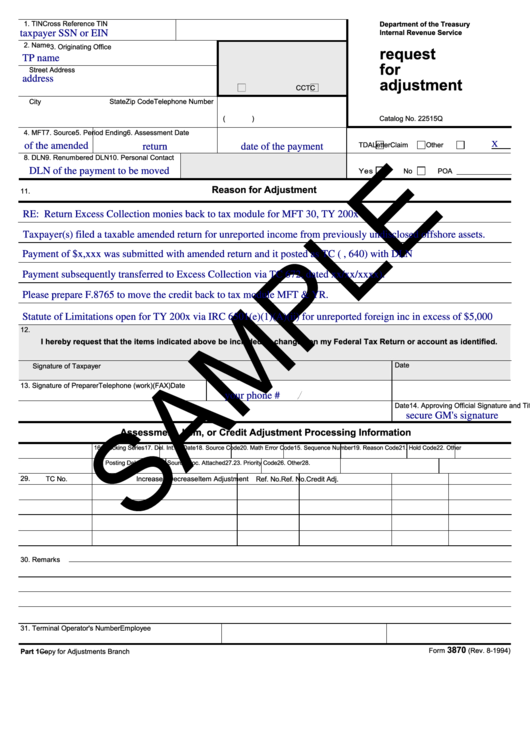

Request For Adjustment Form 3870

Download a blank fillable Request For Adjustment Form 3870 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Request For Adjustment Form 3870 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

1. TIN

Cross Reference TIN

Department of the Treasury

Internal Revenue Service

taxpayer SSN or EIN

2. Name

3. Originating Office

request

TP name

for

Street Address

address

adjustment

TC

CC

State

Zip Code

Telephone Number

City

(

)

Catalog No. 22515Q

4. MFT

5. Period Ending

7. Source

6. Assessment Date

X

TDA

Letter

Claim

Other

of the amended

return

date of the payment

8. DLN

9. Renumbered DLN

10. Personal Contact

DLN of the payment to be moved

Yes

No

POA

Reason for Adjustment

11.

RE: Return Excess Collection monies back to tax module for MFT 30, TY 200x

Taxpayer(s) filed a taxable amended return for unreported income from previously undisclosed offshore assets.

Payment of $x,xxx was submitted with amended return and it posted as TC (e.g. 670, 640) with DLN

Payment subsequently transferred to Excess Collection via TC 672, dated xx/xx/xxxx).

Please prepare F.8765 to move the credit back to tax module MFT & YR.

Statute of Limitations open for TY 200x via IRC 6501(e)(1)(A)(ii) for unreported foreign inc in excess of $5,000

12.

I hereby request that the items indicated above be included or changed on my Federal Tax Return or account as identified.

Date

Signature of Taxpayer

13. Signature of Preparer

Telephone (work)

(FAX)

Date

your phone #

14. Approving Official Signature and Title

Date

secure GM's signature

Assessment, Item, or Credit Adjustment Processing Information

15. Sequence Number

16. Blocking Series

17. Del. Int. to Date

18. Source Code

19. Reason Code

20. Math Error Code

21. Hold Code

22. Other

23. Priority Code

24. Posting Delay Code

25. Source Doc. Attached

26. Other

27.

28.

29.

TC No.

Increase / Decrease

Item Adjustment

Ref. No.

Ref. No.

Credit Adj.

30. Remarks

31. Terminal Operator's Number

Employee I.D.

Date Input

3870

Form

(Rev. 8-1994)

publish.no.irs.gov

Part 1

Copy for Adjustments Branch

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4