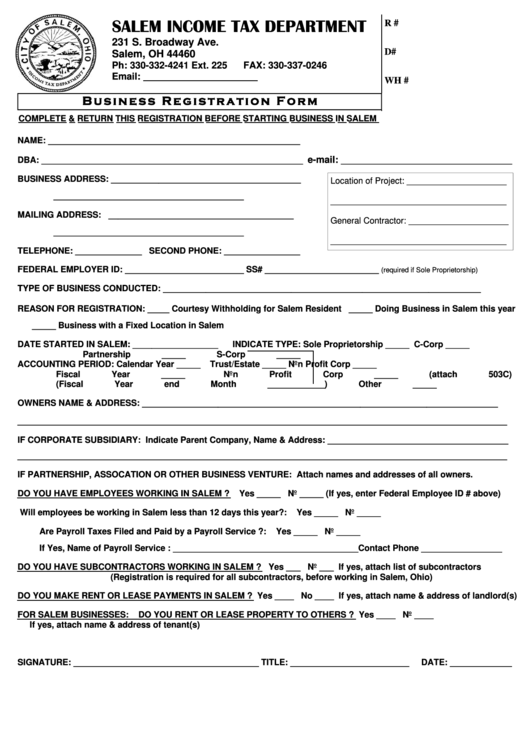

Business Registration Form

ADVERTISEMENT

SALEM INCOME TAX DEPARTMENT

R #

231 S. Broadway Ave.

D#

Salem, OH 44460

Ph: 330-332-4241 Ext. 225

FAX: 330-337-0246

Email:

WH #

B u s i n e s s R e g i s t r a t i o n Fo r m

COMPLETE & RETURN THIS REGISTRATION BEFORE STARTING BUSINESS IN SALEM

NAME: _____________________________________________________

e-mail:

DBA: _______________________________________________________

____________________________________

BUSINESS ADDRESS: ________________________________________

Location of Project: _____________________

________________________________________

_____________________________________

MAILING ADDRESS: _______________________________________

General Contractor: _____________________

________________________________________

_____________________________________

TELEPHONE: ______________ SECOND PHONE: ________________

FEDERAL EMPLOYER ID: _________________________

SS# ________________________

(required if Sole Proprietorship)

TYPE OF BUSINESS CONDUCTED: ___________________________________________________________________

REASON FOR REGISTRATION: _____ Courtesy Withholding for Salem Resident _____ Doing Business in Salem this year

_____ Business with a Fixed Location in Salem

DATE STARTED IN SALEM: __________________

INDICATE TYPE:

Sole Proprietorship _____ C-Corp _____

Partnership _____

S-Corp _____

ACCOUNTING PERIOD:

Calendar Year _____

Trust/Estate _____

Non Profit Corp _____

Fiscal Year _____

Non Profit Corp _____ (attach 503C)

(Fiscal Year end Month ____________)

Other _____

OWNERS NAME & ADDRESS: ___________________________________________________________________________

_______________________________________________________________________________________________________

IF CORPORATE SUBSIDIARY: Indicate Parent Company, Name & Address: ______________________________________

_______________________________________________________________________________________________________

IF PARTNERSHIP, ASSOCATION OR OTHER BUSINESS VENTURE: Attach names and addresses of all owners.

DO YOU HAVE EMPLOYEES WORKING IN SALEM ?

Yes _____ No _____ (If yes, enter Federal Employee ID # above)

Will employees be working in Salem less than 12 days this year?:

Yes _____ No _____

Are Payroll Taxes Filed and Paid by a Payroll Service ?:

Yes _____ No _____

If Yes, Name of Payroll Service : _______________________________________Contact Phone _________________

DO YOU HAVE SUBCONTRACTORS WORKING IN SALEM ? Yes ___ No ___ If yes, attach list of subcontractors

(Registration is required for all subcontractors, before working in Salem, Ohio)

DO YOU MAKE RENT OR LEASE PAYMENTS IN SALEM ? Yes ____ No ____ If yes, attach name & address of landlord(s)

FOR SALEM BUSINESSES:

DO YOU RENT OR LEASE PROPERTY TO OTHERS ? Yes ____ No ____

If yes, attach name & address of tenant(s)

SIGNATURE: _______________________________________ TITLE: _________________________

DATE: _____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1