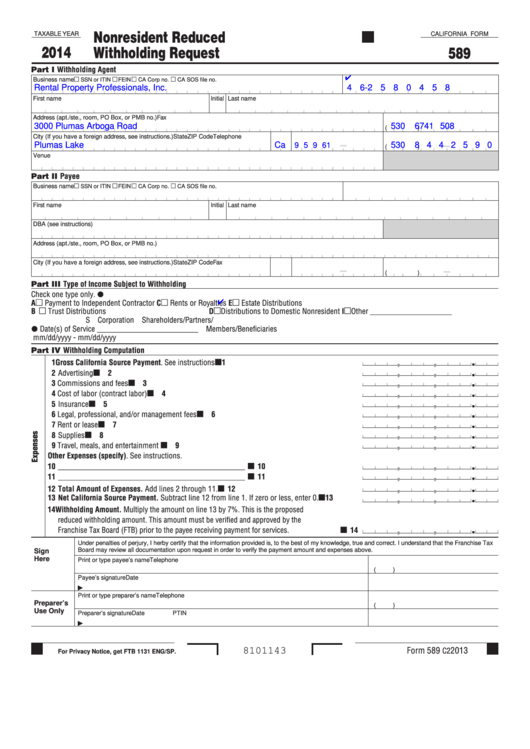

Nonresident Reduced

TAXABLE YEAR

CALIFORNIA FORM

2014

Withholding Request

589

Part I Withholding Agent

m

m

m

m

Business name

SSN or ITIN

FEIN

CA Corp no.

CA SOS file no.

Rental Property Professionals, Inc.

4 6 -

2 5 8 0 4 5 8

First name

Initial Last name

Address (apt./ste., room, PO Box, or PMB no.)

Fax

–

3000 Plumas Arboga Road

530 6 7 4 1 5 0 8

(

)

City (If you have a foreign address, see instructions.)

State

ZIP Code

Telephone

–

–

Plumas Lake

Ca

9 5 9 6 1

530 8 4 4 2 5 9 0

(

)

Venue

Part II Payee

m

m

m

m

Business name

SSN or ITIN

FEIN

CA Corp no.

CA SOS file no.

First name

Initial Last name

DBA (see instructions)

Address (apt./ste., room, PO Box, or PMB no.)

City (If you have a foreign address, see instructions.)

State

ZIP Code

Fax

–

–

(

)

Part III Type of Income Subject to Withholding

I

Check one type only.

m

m

m

A

Payment to Independent Contractor

C

Rents or Royalties

E

Estate Distributions

m

m

m

B

Trust Distributions

D

Distributions to Domestic Nonresident

I

Other _____________________

S Corporation Shareholders/Partners/

I

Date(s) of Service __________________________

Members/Beneficiaries

mm/dd/yyyy - mm/dd/yyyy

Part IV Withholding Computation

K

.

,

,

1 Gross California Source Payment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

K

.

,

,

2 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

K

.

,

,

3 Commissions and fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

K

.

,

,

4 Cost of labor (contract labor) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

K

.

,

,

5 Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

K

.

,

,

6 Legal, professional, and/or management fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

K

.

,

,

7 Rent or lease . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

K

.

,

,

8 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

K

.

,

,

9 Travel, meals, and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Other Expenses (specify). See instructions.

K

.

,

,

10 ________________________________________________ . . . . . . . . . . . . . . . . . . . . . . . .

10

K

.

,

,

11 ________________________________________________ . . . . . . . . . . . . . . . . . . . . . . . .

11

K

.

,

,

12 Total Amount of Expenses. Add lines 2 through 11.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

K

.

,

,

13 Net California Source Payment. Subtract line 12 from line 1. If zero or less, enter 0.. . . . . .

13

14 Withholding Amount. Multiply the amount on line 13 by 7%. This is the proposed

reduced withholding amount. This amount must be verified and approved by the

K

.

,

,

Franchise Tax Board (FTB) prior to the payee receiving payment for services. . . . . . . . . . . . . . .

14

Under penalties of perjury, I herby certify that the information provided is, to the best of my knowledge, true and correct. I understand that the Franchise Tax

Sign

Board may review all documentation upon request in order to verify the payment amount and expenses above.

Here

Print or type payee’s name

T elephone

(

)

Payee’s signature

Date

►

Print or type preparer’s name

Telephone

Preparer’s

(

)

Use Only

Preparer’s signature

Date

PTIN

►

Form 589

2013

C2

8101143

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3