Form Dr-15jez-Application For The Exemption Of Electrical Energy Used In An Enterprise Zone 2009

ADVERTISEMENT

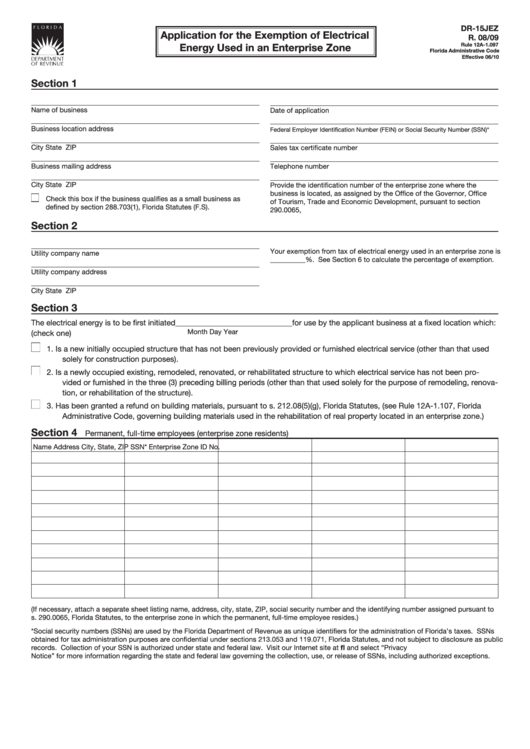

DR-15JEZ

Application for the Exemption of Electrical

R. 08/09

Energy Used in an Enterprise Zone

Rule 12A-1.097

Florida Administrative Code

Effective 06/10

Section 1

Name of business

Date of application

Business location address

Federal Employer Identification Number (FEIN) or Social Security Number (SSN)*

City

State

ZIP

Sales tax certificate number

Business mailing address

Telephone number

City

State

ZIP

Provide the identification number of the enterprise zone where the

business is located, as assigned by the Office of the Governor, Office

■

Check this box if the business qualifies as a small business as

of Tourism, Trade and Economic Development, pursuant to section

defined by section 288.703(1), Florida Statutes (F.S).

290.0065, F.S.

Section 2

Your exemption from tax of electrical energy used in an enterprise zone is

Utility company name

__________%. See Section 6 to calculate the percentage of exemption.

Utility company address

City

State

ZIP

Section 3

The electrical energy is to be first initiated______________________________for use by the applicant business at a fixed location which:

Month

Day

Year

(check one)

■

1.

Is a new initially occupied structure that has not been previously provided or furnished electrical service (other than that used

solely for construction purposes).

■

2.

Is a newly occupied existing, remodeled, renovated, or rehabilitated structure to which electrical service has not been pro-

vided or furnished in the three (3) preceding billing periods (other than that used solely for the purpose of remodeling, renova-

tion, or rehabilitation of the structure).

■

3.

Has been granted a refund on building materials, pursuant to s. 212.08(5)(g), Florida Statutes, (see Rule 12A-1.107, Florida

Administrative Code, governing building materials used in the rehabilitation of real property located in an enterprise zone.)

Section 4

Permanent, full-time employees (enterprise zone residents)

Name

Address

City, State, ZIP

SSN*

Enterprise Zone ID No.

(If necessary, attach a separate sheet listing name, address, city, state, ZIP, social security number and the identifying number assigned pursuant to

s. 290.0065, Florida Statutes, to the enterprise zone in which the permanent, full-time employee resides.)

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public

records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at and select “Privacy

Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2