Simplified Change Report For Supplemental Nutrition Assistance Program (Snap)

ADVERTISEMENT

SM

Simplified Reporting System

Keep this for future use. It explains simplified reporting.

What is simplified reporting?

The Simplified Reporting System (SRS) is a way for some Supplemental Nutrition Assistance Program

(SNAP) clients to report changes. In SRS, you must report changes every six months answering the

questions on the Interim Change Report (DHS 0852) that is sent to you. You may also need to report

other changes during that six month period.

What to report?

Between report periods you must report the changes listed below. Report these changes by the tenth

day of the month after the change happens. You can report these to the Department of Human Services

(DHS) in writing, by phone or in person.

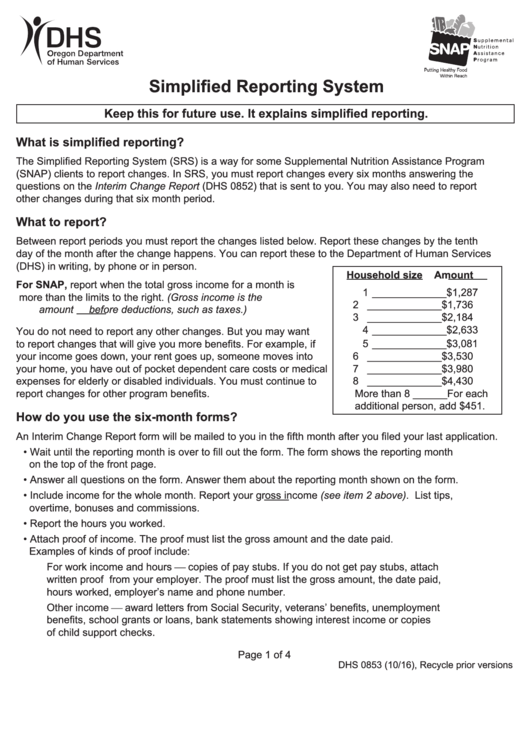

Household size

Amount

For SNAP, report when the total gross income for a month is

1 _____________ $1,287

more than the limits to the right. (Gross income is the

2 _____________ $1,736

amount before deductions, such as taxes.)

3 _____________ $2,184

4 _____________ $2,633

You do not need to report any other changes. But you may want

to report changes that will give you more benefits. For example, if

5 _____________ $3,081

your income goes down, your rent goes up, someone moves into

6 _____________ $3,530

7 _____________ $3,980

your home, you have out of pocket dependent care costs or medical

expenses for elderly or disabled individuals. You must continue to

8 _____________ $4,430

report changes for other program benefits.

More than 8 ______For each

additional person, add $451.

How do you use the six-month forms?

An Interim Change Report form will be mailed to you in the fifth month after you filed your last application.

• Wait until the reporting month is over to fill out the form. The form shows the reporting month

on the top of the front page.

• Answer all questions on the form. Answer them about the reporting month shown on the form.

• Include income for the whole month. Report your gross income (see item 2 above). List tips,

overtime, bonuses and commissions.

• Report the hours you worked.

• Attach proof of income. The proof must list the gross amount and the date paid.

Examples of kinds of proof include:

For work income and hours copies of pay stubs. If you do not get pay stubs, attach

written proof from your employer. The proof must list the gross amount, the date paid,

hours worked, employer’s name and phone number.

Other income award letters from Social Security, veterans’ benefits, unemployment

benefits, school grants or loans, bank statements showing interest income or copies

of child support checks.

Page 1 of 4

DHS 0853 (10/16), Recycle prior versions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4