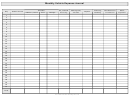

Monthly Living Expenses

ADVERTISEMENT

Credit Counseling Service of North Central Indiana

A Program of Family Service Association of Howard County, Inc

618 S Main

Phone 765-454-7290

Kokomo IN 46901

Fax 765-454-7294

PREPARING A HOUSEHOLD BUDGET

One of the most important items we can use to assist with household finances is a budget. Once

developed, a budget takes only a few minutes to maintain, and can make the difference between

financial success and failure. To be successful, the household budget must be used and reviewed on a

regular basis - say, once a week when you sit down to work on your bills. Revise and refine the budget

for the coming periods, and it will help to keep you on track financially.

Some notes about budgeting:

1. Always start working on next month's budget by the middle of the current month. Look and plan

ahead to be successful.

2. Remember that the budget is a spending and saving plan or goal. It will seldom be 100% accurate,

but should reflect a reasonable plan for the household.

3. It is generally easiest to develop your budget based on pay periods. Don't forget that if you are paid

weekly you will have an extra paycheck each 3 months. Those paid every other week will have an

extra check every 6 months. (The extra check does not, however, mean that you will have lots of

extra money! Depending on how your budget is set up, some expenses, such as food or gasoline

occur each and every week. Other expenses, like housing and utilities occur only once in each

calendar month.)

4. As you develop a budget, be honest with yourself. Over-estimating income or under-estimating

expenses will work against you. Adjust figures used in your budget to reflect accurate information

(if you guessed your electric bill to be $54 and it comes in at $74, go to your budget and adjust it.)

5. Don't forget to budget for those items that don't come up every month. These might include

insurance for home and auto, license plates and sanitation to name a few. To determine how much

should be budgeted, divide the projected expense by the period it covers. For example an auto

insurance policy of $180 that covers a period of 6 months would be budgeted at $30 per month.

6. There are a number of areas that are hard to assign a budgeted amount to, but are still important to

the success of a budget. Some examples might include:

”Building Strong Families”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4