Your Personal Budget Template

Download a blank fillable Your Personal Budget Template in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Your Personal Budget Template with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

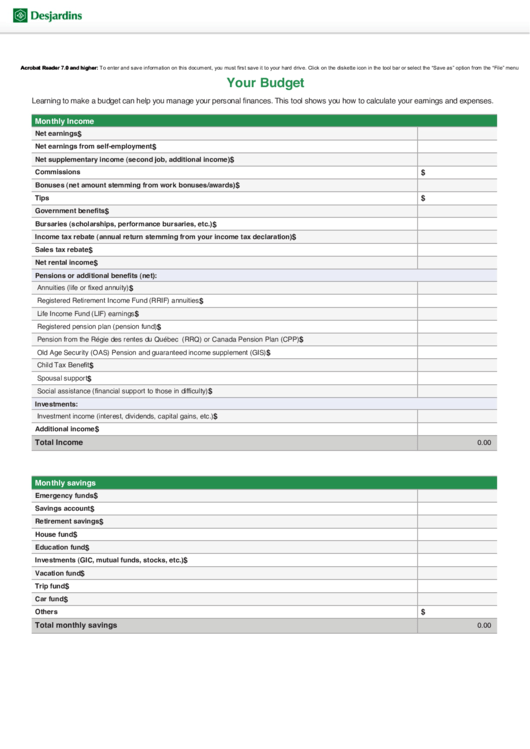

Acrobat Reader 7.0 and higher: To enter and save information on this document, you must first save it to your hard drive. Click on the diskette icon in the tool bar or select the “Save as” option from the “File” menu.

Your Budget

Learning to make a budget can help you manage your personal finances. This tool shows you how to calculate your earnings and expenses.

Monthly Income

$

Net earnings

Net earnings from self-employment

$

$

Net supplementary income (second job, additional income)

$

Commissions

$

Bonuses (net amount stemming from work bonuses/awards)

$

Tips

$

Government benefits

Bursaries (scholarships, performance bursaries, etc.)

$

$

Income tax rebate (annual return stemming from your income tax declaration)

$

Sales tax rebate

$

Net rental income

Pensions or additional benefits (net):

$

Annuities (life or fixed annuity)

$

Registered Retirement Income Fund (RRIF) annuities

$

Life Income Fund (LIF) earnings

$

Registered pension plan (pension fund)

$

Pension from the Régie des rentes du Québec (RRQ) or Canada Pension Plan (CPP)

$

Old Age Security (OAS) Pension and guaranteed income supplement (GIS)

$

Child Tax Benefit

$

Spousal support

$

Social assistance (financial support to those in difficulty)

Investments:

$

Investment income (interest, dividends, capital gains, etc.)

$

Additional income

Total Income

0.00

Monthly savings

$

Emergency funds

Savings account

$

$

Retirement savings

$

House fund

$

Education fund

$

Investments (GIC, mutual funds, stocks, etc.)

Vacation fund

$

$

Trip fund

$

Car fund

$

Others

Total monthly savings

0.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3