Form Ssa-2490-Bk - Application For Benefits Form Page 5

ADVERTISEMENT

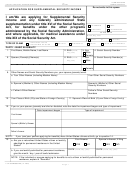

(a) During the past 24 months, did the worker engage in employment or

15.

Yes

No

self-employment covered by the U.S. Social Security system?

(If "Yes" answer

(If "No" go on

(b) and (c) below.)

to item 16.)

List the periods of work covered by the U.S. Social Security system and the name and address of the

employer or self-employment activity

(b) Name and address of employer or self-employment

Work Began

Work Ended

activity

(Month-Year)

(Month-Year)

(c) May we ask any employer listed above for wage information needed

Yes

No

to process this claim?

INFORMATION ABOUT DEPENDENTS FOR WHOM BENEFITS ARE CLAIMED

(a) Are there any children of the worker who are now, or were

16.

Under age 18

Yes

No

in the past 12 months, unmarried and:

OR

Age 18 or over and a

Yes

No

student or disabled

If either block is checked "Yes", enter the information for each child. NOTE: Children include natural children,

step-children and adopted children plus grandchildren living in the same household as the worker.

(c) Relationship to

(d) Sex

(e) Date of birth

(b) Name of child

worker

(M or F)

(Month, day, year)

The spouse, widow or widower of the worker may be eligible for a benefit. In addition, a former spouse of

17.

the worker may be eligible as a divorced spouse, widow or widower. Provide the following information about

any spouse or former spouse of the worker.

SPOUSE

FORMER SPOUSE

FORMER SPOUSE

(a) Name (including

maiden name)

(b) Date of Birth

(Mo., day, yr.)

(c) Date of Marriage

(Mo., day, yr.)

(d) Date of Divorce

(if any)

(Mo., day, yr.)

(e) Country of

Citizenship

(f) Social Insurance

Number in

foreign country

(g) U. S. Social

Security Number

(if any)

Form SSA-2490-BK (4-2004)

EF (4-2004)

Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7