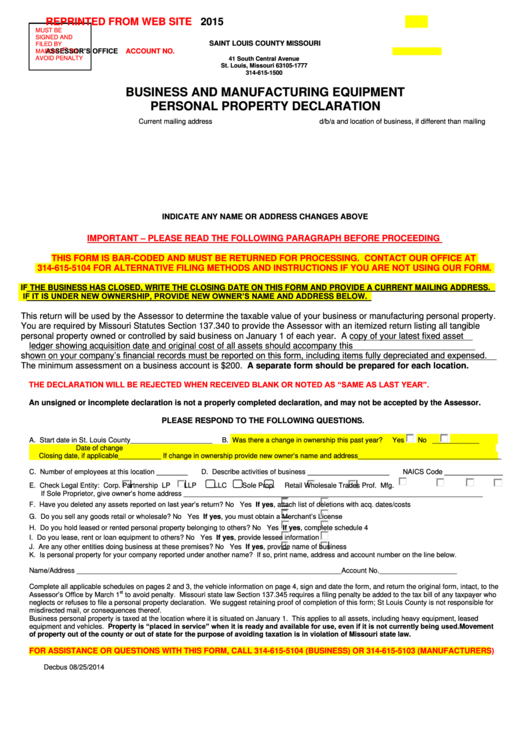

Business And Manufacturing Equipment Personal Property Declaration

ADVERTISEMENT

REPRINTED FROM WEB SITE

2015

MUST BE

SIGNED AND

SAINT LOUIS COUNTY MISSOURI

FILED BY

ST

ASSESSOR’S OFFICE

ACCOUNT NO.

MARCH 1

TO

AVOID PENALTY

41 South Central Avenue

St. Louis, Missouri 63105-1777

314-615-1500

BUSINESS AND MANUFACTURING EQUIPMENT

PERSONAL PROPERTY DECLARATION

Current mailing address

d/b/a and location of business, if different than mailing

INDICATE ANY NAME OR ADDRESS CHANGES ABOVE

IMPORTANT – PLEASE READ THE FOLLOWING PARAGRAPH BEFORE PROCEEDING

THIS FORM IS BAR-CODED AND MUST BE RETURNED FOR PROCESSING. CONTACT OUR OFFICE AT

314-615-5104 FOR ALTERNATIVE FILING METHODS AND INSTRUCTIONS IF YOU ARE NOT USING OUR FORM.

IF THE BUSINESS HAS CLOSED, WRITE THE CLOSING DATE ON THIS FORM AND PROVIDE A CURRENT MAILING ADDRESS.

IF IT IS UNDER NEW OWNERSHIP, PROVIDE NEW OWNER’S NAME AND ADDRESS BELOW.

This return will be used by the Assessor to determine the taxable value of your business or manufacturing personal property.

You are required by Missouri Statutes Section 137.340 to provide the Assessor with an itemized return listing all tangible

personal property owned or controlled by said business on January 1 of each year. A copy of your latest fixed asset

ledger showing acquisition date and original cost of all assets should accompany this declaration. All fixed assets as

shown on your company’s financial records must be reported on this form, including items fully depreciated and expensed.

The minimum assessment on a business account is $200. A separate form should be prepared for each location.

THE DECLARATION WILL BE REJECTED WHEN RECEIVED BLANK OR NOTED AS “SAME AS LAST YEAR”.

An unsigned or incomplete declaration is not a properly completed declaration, and may not be accepted by the Assessor.

PLEASE RESPOND TO THE FOLLOWING QUESTIONS.

A. Start date in St. Louis County_____________________

B. Was there a change in ownership this past year?

Yes

No

____________

Date of change

Closing date, if applicable___________ If change in ownership provide new owner’s name and address_____________________________________

C. Number of employees at this location ________

D. Describe activities of business _____________________

NAICS Code _______________

E. Check Legal Entity: Corp.

Partnership

LP

LLP

LLC

Sole Prop.

Retail

Wholesale

Trades

Prof.

Mfg.

If Sole Proprietor, give owner’s home address _____________________________________________________________________________

F. Have you deleted any assets reported on last year’s return?

No

Yes

If yes, attach list of deletions with acq. dates/costs

If yes, you must obtain a Merchant’s License

G. Do you sell any goods retail or wholesale?

No

Yes

H. Do you hold leased or rented personal property belonging to others?

No

Yes

If yes, complete schedule 4

I. Do you lease, rent or loan equipment to others?

No

Yes

If yes, provide lessee information

J. Are any other entities doing business at these premises?

No

Yes

If yes, provide name of business

K. Is personal property for your company reported under another name? If so, print name, address and account number on the line below.

Name/Address ____________________________________________________________________Account No.____________________

Complete all applicable schedules on pages 2 and 3, the vehicle information on page 4, sign and date the form, and return the original form, intact, to the

Assessor’s Office by March 1

st

to avoid penalty. Missouri state law Section 137.345 requires a filing penalty be added to the tax bill of any taxpayer who

neglects or refuses to file a personal property declaration. We suggest retaining proof of completion of this form; St Louis County is not responsible for

misdirected mail, or consequences thereof.

Business personal property is taxed at the location where it is situated on January 1. This applies to all assets, including heavy equipment, leased

equipment and vehicles. Property is “placed in service” when it is ready and available for use, even if it is not currently being used. Movement

of property out of the county or out of state for the purpose of avoiding taxation is in violation of Missouri state law.

FOR ASSISTANCE OR QUESTIONS WITH THIS FORM, CALL 314-615-5104 (BUSINESS) OR 314-615-5103 (MANUFACTURERS)

Decbus 08/25/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4