Employee Business Expenses

Download a blank fillable Employee Business Expenses in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Employee Business Expenses with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

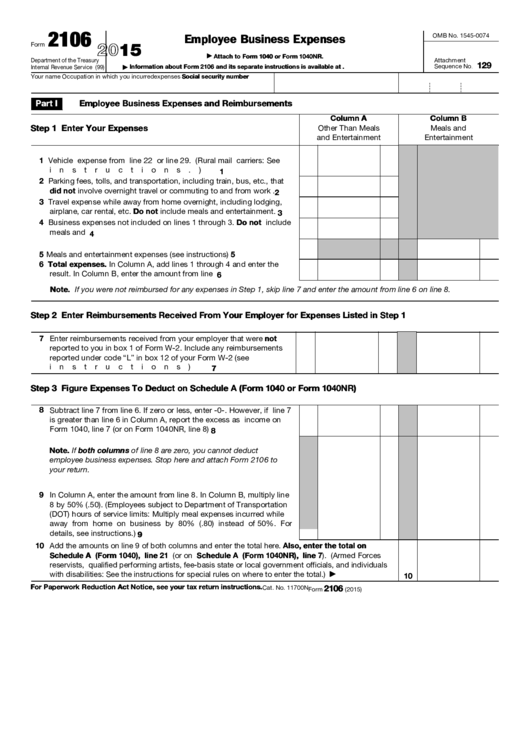

2106

Employee Business Expenses

OMB No. 1545-0074

2015

Form

Attach to Form 1040 or Form 1040NR.

▶

Department of the Treasury

Attachment

129

Information about Form 2106 and its separate instructions is available at

Sequence No

Internal Revenue Service (99)

.

▶

Your name

Occupation in which you incurred expenses Social security number

Part I

Employee Business Expenses and Reimbursements

Column A

Column B

Step 1 Enter Your Expenses

Other Than Meals

Meals and

and Entertainment

Entertainment

1 Vehicle expense from line 22 or line 29. (Rural mail carriers: See

instructions.)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2 Parking fees, tolls, and transportation, including train, bus, etc., that

did not involve overnight travel or commuting to and from work

.

2

3 Travel expense while away from home overnight, including lodging,

airplane, car rental, etc. Do not include meals and entertainment .

3

4 Business expenses not included on lines 1 through 3. Do not include

meals and entertainment

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5 Meals and entertainment expenses (see instructions) .

5

.

.

.

.

6 Total expenses. In Column A, add lines 1 through 4 and enter the

result. In Column B, enter the amount from line 5

.

.

.

.

.

.

6

Note. If you were not reimbursed for any expenses in Step 1, skip line 7 and enter the amount from line 6 on line 8.

Step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

7 Enter reimbursements received from your employer that were not

reported to you in box 1 of Form W-2. Include any reimbursements

reported under code “L” in box 12 of your Form W-2 (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Step 3 Figure Expenses To Deduct on Schedule A (Form 1040 or Form 1040NR)

8 Subtract line 7 from line 6. If zero or less, enter -0-. However, if line 7

is greater than line 6 in Column A, report the excess as income on

Form 1040, line 7 (or on Form 1040NR, line 8)

.

.

.

.

.

.

.

8

Note. If both columns of line 8 are zero, you cannot deduct

employee business expenses. Stop here and attach Form 2106 to

your return.

9 In Column A, enter the amount from line 8. In Column B, multiply line

8 by 50% (.50). (Employees subject to Department of Transportation

(DOT) hours of service limits: Multiply meal expenses incurred while

away from home on business by 80% (.80) instead of 50%. For

details, see instructions.)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10 Add the amounts on line 9 of both columns and enter the total here. Also, enter the total on

Schedule A (Form 1040), line 21 (or on Schedule A (Form 1040NR), line 7). (Armed Forces

reservists, qualified performing artists, fee-basis state or local government officials, and individuals

with disabilities: See the instructions for special rules on where to enter the total.) .

.

.

.

.

10

▶

For Paperwork Reduction Act Notice, see your tax return instructions.

2106

Cat. No. 11700N

Form

(2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2