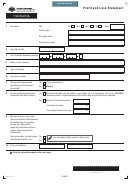

Profit And Loss Statement Page 2

Download a blank fillable Profit And Loss Statement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Profit And Loss Statement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Notes

The following notes are provided as a guide for our assessment purposes only.

Allowable deductions

Only expenses necessarily incurred in earning business income are allowed as deductions.

For example, travel expenses incurred as part of business operations are allowable, but costs of

personal travel are not. Where the expenses are incurred for part business and part personal reasons,

only that part which relates to your business may be deducted from your business income.

Deductions for superannuation paid to an employee’s accounts are allowable in certain

circumstances. Ask us for more information.

Some legitimate deductions under tax law are not allowed for our income assessment

purposes. These include:

• Prior year losses (section 8-1 of the Income Tax Assessment Act 1997 )

• Offsetting of losses

Losses can be offset only in some situations. Ask us for more information.

• Superannuation contributions for the sole trader or partners of the partnership

• Borrowing expenses

• Donations

• Industry concessions/incentives

– Income Equalisation Deposits/Farm Management Bonds

– income averaging

– provisions to defer taxation

– forced disposal of livestock (section 36AAA or sub-sections 36(3) to (7)

Income Tax Assessment Act 1936 (ITAA 1936))

– double wool clip (section 26BA ITAA 1936), and

– insurance received for timber or stock losses (section 26B ITAA 1936).

• Insurance

Private health insurance or premiums paid on term life, endowment or disability policies.

• Capital expenditure deductions

Some capital expenses related to primary production that are allowed for tax purposes are not

allowed as deductions for our purposes. These include:

• Equal annual deductions over 10 years under section 75A of the ITAA 1936 for expenditure before

23 August 1983 on such items as:

– clearing and preparation of land for agriculture and farming

– drainage of swamps

– soil conservation measures

– flood mitigation measures

• Water storage and reticulation expenditure (section 75B ITAA 1936)

• Fences for disease control (section 75C ITAA 1936)

• Prevention of land degradation (section 75D ITAA 1936)

• A deduction from taxable income under section 36AAA of the ITAA 1936.

• Union fees

Section 51(1) of the ITAA 1936 provides for a deduction against gross business income in respect

of union membership fees. Union fees are not allowed as a deduction for the Department of

Human Services income test assessment purposes, unless membership is a requirement for

undertaking business activities in the applicable industry.

Income of recipient

Amount paid and claimed as an expense item may need to be declared as income of the recipient.

For example, if the business pays rent or wages to you or your partner, you will need to declare the

amount as income.

SU580.1404

2 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5