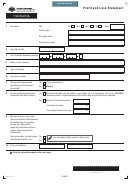

Profit And Loss Statement Page 4

Download a blank fillable Profit And Loss Statement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Profit And Loss Statement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

11

Gross business income for the period of statement

(A)

$

Annual amount

Amount for period

12

Non variable expenses

(e.g. from tax return)

of statement

Accountancy (not tax agents)

$

$

Depreciation (see tax return if available)

$

$

Insurance premiums (e.g. business premises, public liability,

$

$

sickness and accident, stock, motor vehicle)

Interest on money borrowed for business use

$

$

Levies, licence fees and government charges

$

$

Registration of motor vehicles less percentage of private use

$

$

Rent or rates less percentage of private use

$

$

Other (Give details – attach a separate list if needed)

$

$

$

$

0

Sub-total

$

(B)

13

Advertising

$

Variable expenses

Bank charges (on business accounts)

$

Amount should reflect the

Cost of goods sold in period — see description*

$

period of statement

(e.g. if the statement covers a

Freight, cartage and travelling expenses

$

3 month period, divide an annual

Motor vehicle running costs (check tax pack for calculation)

$

figure by 4).

Hire (plant and equipment)

$

*Cost of goods sold

Journals and periodicals for business use

$

Opening stock at start of period

Power cost for business use

$

plus purchases in period less

Telephone costs for business use

$

closing stock at end of period.

Printing and stationery

$

Materials (hardware, chemicals, parts etc.)

$

Repairs and maintenance (unless included as part of motor vehicle expenses)

$

Wages/salary paid

$

Capital items (e.g. tools, office equipment)

– each item purchased for less than $300 (or up to the amount allowed

$

as a concession if using the Small business entity concessions)

Other (Give details – attach a separate list if needed)

$

$

0

Sub-total

$

(C)

14

Total of all expenses (B) plus (C)

(D)

$

15

Net income (A) less (D)

PROFIT OR LOSS

$

SU580.1404

4 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5