Iowa Eligibility Application Form

ADVERTISEMENT

5/14

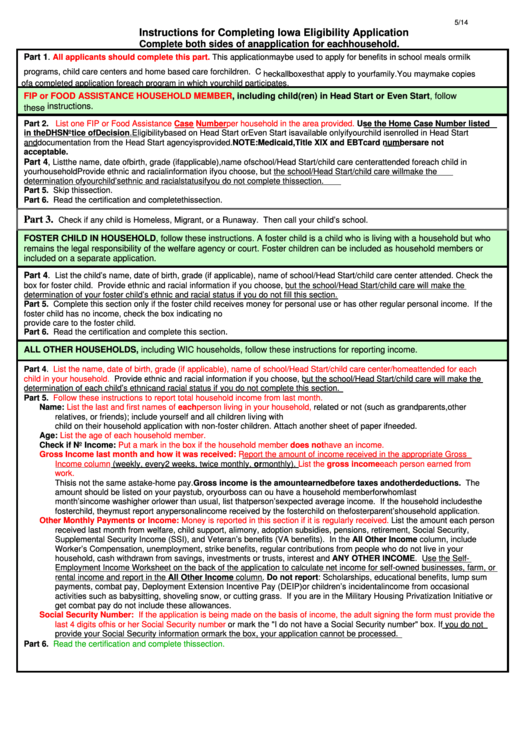

Instructions for Completing Iowa Eligibility Application

Complete both sides of an application for each household.

Part 1.

All applicants should complete this part.

This applicati on may be used to apply for benefits in school meals or milk

programs, child care centers and home based care for children. C heck all boxes that apply to your family. You may make copies

of a completed application for each program in which your child participates

.

FIP or FOOD ASSISTANCE HOUSEHOLD

MEMBER, including child(ren) in Head Start or Even Start, follow

these i nstructions.

Part 2.

List one FIP or Food Assistance Case Number per household in the area provided.

Use the Home Case Number listed

in the DHS Notice of Decision. Eligibility based on Head Start or Even Start is available only if your child is enrolled in Head Start

and documentation from the Head Start agency is provided. NOTE: Medicaid, Title XIX and EBT card numbers are not

acceptable.

Part 4, List the name, date of birth, grade (if applicable), name of school/Head Start/child care center attended for each child in

your household Provide ethnic and racial information if you choose, but the school/Head Start/child care will make the

determination of your child’s ethnic and racial status if you do not complete this section.

Part 5. Skip this section.

Part 6. Read the certification and complete this section.

Part 3.

Check if any child is Homeless, Migrant, or a Runaway. Then call your child’s school.

FOSTER CHILD IN HOUSEHOLD, follow these instructions. A foster child is a child who is living with a household but who

remains the legal responsibility of the welfare agency or court. Foster children can be included as household members or

included on a separate application.

Part 4. List the child’s name, date of birth, grade (if applicable), name of school/Head Start/child care center attended. Check the

box for foster child. Provide ethnic and racial information if you choose, but the school/Head Start/child care will make the

determination of your foster child’s ethnic and racial status if you do not fill this section.

Part 5. Complete this section only if the foster child receives money for personal use or has other regular personal income. If the

foster child has no income, check the box indicating no income. DO NOT include the stipend received by the foster family to

provide care to the foster child.

.

Part 6. Read the certification and complete this section

ALL OTHER HOUSEHOLDS, including WIC households, follow these instructions for reporting income.

Part 4.

List the name, date of birth, grade (if applicable), name of school/Head Start/child care center/home attended for each

child in your household.

Provide ethnic and racial information if you choose, but the school/Head Start/child care will make the

determination of each child’s ethnic and racial status if you do not complete this section.

Part 5.

Follow these instructions to report total household income from last month.

Name:

List the last and first names of each person living in your household,

related or not (such as grandparents, other

relatives, or friends); include yourself and all children living with you. The household decides whether to include the foster

child on their household application with non-foster children. Attach another sheet of paper if needed.

Age:

List the age of each household member.

Check if No Income:

Put a mark in the box if the household member does not have an income.

Gross Income last month and how it was received: Report the amount of income received in the appropriate Gross

Income column

(weekly, every 2 weeks, twice monthly, or monthly).

List the gross income each person earned from

work.

This is not the same as take-home pay. Gross income is the amount earned before taxes and other deductions. The

amount should be listed on your pay stub, or your boss can tell you. If you have a household member for whom last

month’s income was higher or lower than usual, list that person’s expected average income. If the household includes the

foster child, they must report any personal income received by the foster child on the foster parent’s household application.

Other Monthly Payments or Income: Money is reported in this section if it is regularly received.

List the amount each person

received last month from welfare, child support, alimony, adoption subsidies, pensions, retirement, Social Security,

Supplemental Security Income (SSI), and Veteran’s benefits (VA benefits). In the All Other Income column, include

Worker’s Compensation, unemployment, strike benefits, regular contributions from people who do not live in your

household, cash withdrawn from savings, investments or trusts, interest and ANY OTHER INCOME. Use the Self-

Employment Income Worksheet on the back of the application to calculate net income for self-owned businesses, farm, or

rental income and report in the All Other Income column. Do not report: Scholarships, educational benefits, lump sum

payments, combat pay, Deployment Extension Incentive Pay (DEIP) or children’s incidental income from occasional

activities such as babysitting, shoveling snow, or cutting grass. If you are in the Military Housing Privatization Initiative or

get combat pay do not include these allowances.

Social Security Number: If the application is being made on the basis of income, the adult signing the form must provide the

last 4 digits of his or her Social Security number

or mark the "I do not have a Social Security number" box. If you do not

provide your Social Security information or mark the box, your application cannot be processed.

Part 6.

Read the certification and complete this section.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4