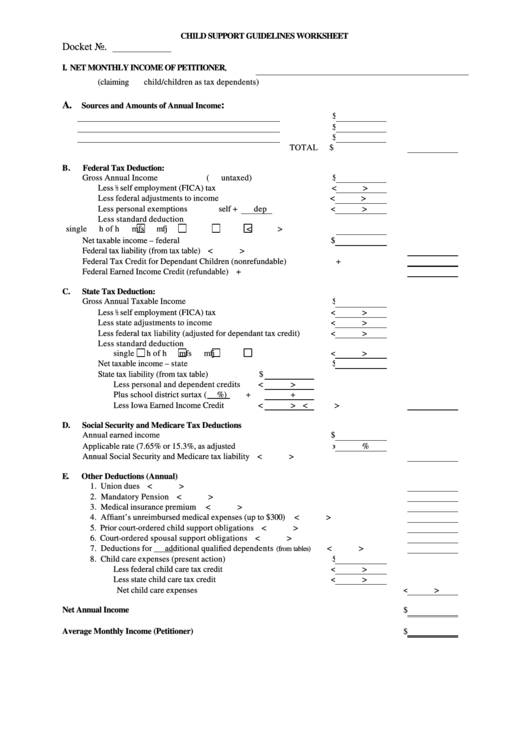

CHILD SUPPORT GUIDELINES WORKSHEET

Docket No.

I. NET MONTHLY INCOME OF PETITIONER,

(claiming

child/children as tax dependents)

A.

:

Sources and Amounts of Annual Income

$

$

$

TOTAL

$

B.

Federal Tax Deduction:

Gross Annual Income

(

untaxed)

$

Less ½ self employment (FICA) tax

<

>

Less federal adjustments to income

<

>

Less personal exemptions

self +

dep

<

>

Less standard deduction

single

h of h

mfs

mfj

<

>

Net taxable income – federal

$

Federal tax liability (from tax table)

<

>

Federal Tax Credit for Dependant Children (nonrefundable)

+

Federal Earned Income Credit (refundable)

+

C.

State Tax Deduction:

Gross Annual Taxable Income

$

Less ½ self employment (FICA) tax

<

>

Less state adjustments to income

<

>

Less federal tax liability (adjusted for dependant tax credit)

<

>

Less standard deduction

single

h of h

mfs

mfj

<

>

Net taxable income – state

$

State tax liability (from tax table)

$

Less personal and dependent credits

<

>

Plus school district surtax (

%)

+

+

Less Iowa Earned Income Credit

<

>

<

>

D.

Social Security and Medicare Tax Deductions

Annual earned income

$

Applicable rate (7.65% or 15.3%, as adjusted

x

%

Annual Social Security and Medicare tax liability

<

>

E.

Other Deductions (Annual)

1. Union dues

<

>

2. Mandatory Pension

<

>

3. Medical insurance premium

<

>

4. Affiant’s unreimbursed medical expenses (up to $300)

<

>

5. Prior court-ordered child support obligations

<

>

6. Court-ordered spousal support obligations

<

>

7. Deductions for

additional qualified dependents

<

>

(from tables)

8. Child care expenses (present action)

$

Less federal child care tax credit

<

>

Less state child care tax credit

<

>

Net child care expenses

<

>

Net Annual Income

$

Average Monthly Income (Petitioner)

$

1

1 2

2 3

3