Sec 1685 (1-12) - Form 13f

Download a blank fillable Sec 1685 (1-12) - Form 13f in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Sec 1685 (1-12) - Form 13f with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

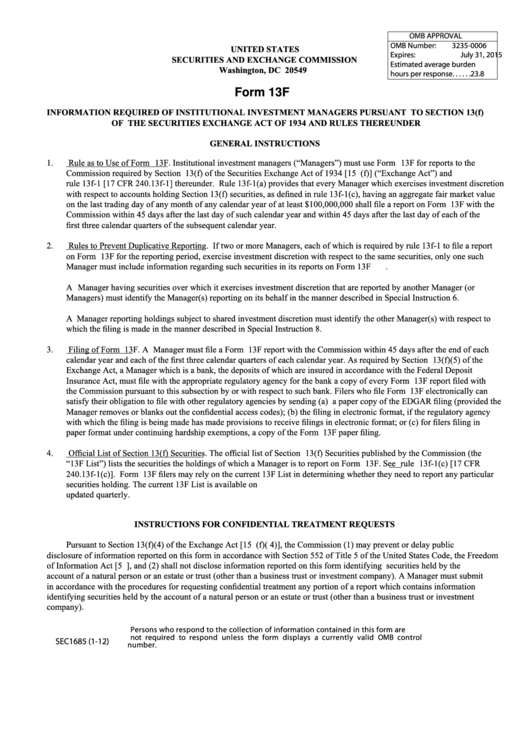

OMB APPROVAL

OMB Number:

3235-0006

UNITED STATES

Expires: b

July 31, 2015

SECURITIES AND EXCHANGE COMMISSION

Estimated average burden

Washington, DC 20549

hours per response. . . . . .23.8

Form 13F

INFORMATION REQUIRED OF INSTITUTIONAL INVESTMENT MANAGERS PURSUANT TO SECTION 13(f)

OF THE SECURITIES EXCHANGE ACT OF 1934 AND RULES THEREUNDER

GENERAL INSTRUCTIONS

1.

Rule as to Use of Form 13F. Institutional investment managers (“Managers”) must use Form 13F for reports to the

Commission required by Section 13(f) of the Securities Exchange Act of 1934 [15 U.S.C. 78m(f)] (“Exchange Act”) and

rule 13f-1 [17 CFR 240.13f-1] thereunder. Rule 13f-1(a) provides that every Manager which exercises investment discretion

with respect to accounts holding Section 13(f) securities, as defined in rule 13f-1(c), having an aggregate fair market value

on the last trading day of any month of any calendar year of at least $100,000,000 shall file a report on Form 13F with the

Commission within 45 days after the last day of such calendar year and within 45 days after the last day of each of the

first three calendar quarters of the subsequent calendar year.

2.

Rules to Prevent Duplicative Reporting. If two or more Managers, each of which is required by rule 13f-1 to file a report

on Form 13F for the reporting period, exercise investment discretion with respect to the same securities, only one such

Manager must include information regarding such securities in its reports on Form 13F .

A Manager having securities over which it exercises investment discretion that are reported by another Manager (or

Managers) must identify the Manager(s) reporting on its behalf in the manner described in Special Instruction 6.

A Manager reporting holdings subject to shared investment discretion must identify the other Manager(s) with respect to

which the filing is made in the manner described in Special Instruction 8.

3.

Filing of Form 13F. A Manager must file a Form 13F report with the Commission within 45 days after the end of each

calendar year and each of the first three calendar quarters of each calendar year. As required by Section 13(f)(5) of the

Exchange Act, a Manager which is a bank, the deposits of which are insured in accordance with the Federal Deposit

Insurance Act, must file with the appropriate regulatory agency for the bank a copy of every Form 13F report filed with

the Commission pursuant to this subsection by or with respect to such bank. Filers who file Form 13F electronically can

satisfy their obligation to file with other regulatory agencies by sending (a) a paper copy of the EDGAR filing (provided the

Manager removes or blanks out the confidential access codes); (b) the filing in electronic format, if the regulatory agency

with which the filing is being made has made provisions to receive filings in electronic format; or (c) for filers filing in

paper format under continuing hardship exemptions, a copy of the Form 13F paper filing.

4.

Official List of Section 13(f) Securities. The official list of Section 13(f) Securities published by the Commission (the

“13F List”) lists the securities the holdings of which a Manager is to report on Form 13F. See rule 13f-1(c) [17 CFR

240.13f-1(c)]. Form 13F filers may rely on the current 13F List in determining whether they need to report any particular

securities holding. The current 13F List is available on The 13F List is

updated quarterly.

INSTRUCTIONS FOR CONFIDENTIAL TREATMENT REQUESTS

Pursuant to Section 13(f)(4) of the Exchange Act [15 U.S.C. 78m(f)( 4)], the Commission (1) may prevent or delay public

disclosure of information reported on this form in accordance with Section 552 of Title 5 of the United States Code, the Freedom

of Information Act [5 U.S.C. 552], and (2) shall not disclose information reported on this form identifying securities held by the

account of a natural person or an estate or trust (other than a business trust or investment company). A Manager must submit

in accordance with the procedures for requesting confidential treatment any portion of a report which contains information

identifying securities held by the account of a natural person or an estate or trust (other than a business trust or investment

company).

Persons who respond to the collection of information contained in this form are

not required to respond unless the form displays a currently valid OMB control

SEC 1685 (1-12)

number.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11