Schedule F Il-1040 Instructions - Illinois Department Of Revenue - 2013

ADVERTISEMENT

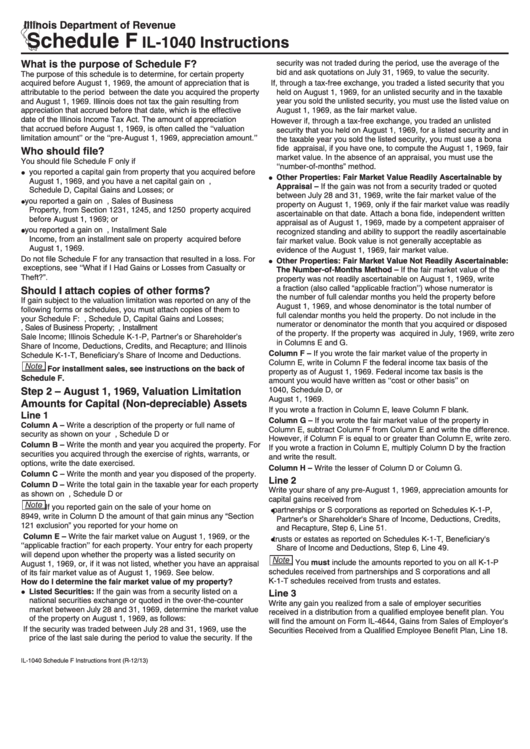

Illinois Department of Revenue

Schedule F

IL-1040 Instructions

What is the purpose of Schedule F?

security was not traded during the period, use the average of the

bid and ask quotations on July 31, 1969, to value the security.

The purpose of this schedule is to determine, for certain property

If, through a tax-free exchange, you traded a listed security that you

acquired before August 1, 1969, the amount of appreciation that is

attributable to the period between the date you acquired the property

held on August 1, 1969, for an unlisted security and in the taxable

and August 1, 1969. Illinois does not tax the gain resulting from

year you sold the unlisted security, you must use the listed value on

August 1, 1969, as the fair market value.

appreciation that accrued before that date, which is the effective

date of the Illinois Income Tax Act. The amount of appreciation

However if, through a tax-free exchange, you traded an unlisted

that accrued before August 1, 1969, is often called the ‘‘valuation

security that you held on August 1, 1969, for a listed security and in

limitation amount’’ or the ‘‘pre-August 1, 1969, appreciation amount.’’

the taxable year you sold the listed security, you must use a bona

fide appraisal, if you have one, to compute the August 1, 1969, fair

Who should file?

market value. In the absence of an appraisal, you must use the

You should file Schedule F only if

‘‘number-of-months” method.

you reported a capital gain from property that you acquired before

Other Properties: Fair Market Value Readily Ascertainable by

August 1, 1969, and you have a net capital gain on U.S. 1040,

Appraisal – If the gain was not from a security traded or quoted

Schedule D, Capital Gains and Losses; or

between July 28 and 31, 1969, write the fair market value of the

you reported a gain on U.S. Form 4797, Sales of Business

property on August 1, 1969, only if the fair market value was readily

Property, from Section 1231, 1245, and 1250 property acquired

ascertainable on that date. Attach a bona fide, independent written

before August 1, 1969; or

appraisal as of August 1, 1969, made by a competent appraiser of

you reported a gain on U.S. Form 6252, Installment Sale

recognized standing and ability to support the readily ascertainable

Income, from an installment sale on property acquired before

fair market value. Book value is not generally acceptable as

August 1, 1969.

evidence of the August 1, 1969, fair market value.

Do not file Schedule F for any transaction that resulted in a loss. For

Other Properties: Fair Market Value Not Readily Ascertainable:

exceptions, see ‘‘What if I Had Gains or Losses from Casualty or

The Number-of-Months Method – If the fair market value of the

Theft?”.

property was not readily ascertainable on August 1, 1969, write

a fraction (also called “applicable fraction’’) whose numerator is

Should I attach copies of other forms?

the number of full calendar months you held the property before

If gain subject to the valuation limitation was reported on any of the

August 1, 1969, and whose denominator is the total number of

following forms or schedules, you must attach copies of them to

full calendar months you held the property. Do not include in the

your Schedule F: U.S. 1040, Schedule D, Capital Gains and Losses;

numerator or denominator the month that you acquired or disposed

U.S. Form 4797, Sales of Business Property; U.S. Form 6252, Installment

of the property. If the property was acquired in July, 1969, write zero

Sale Income; Illinois Schedule K-1-P, Partner’s or Shareholder’s

in Columns E and G.

Share of Income, Deductions, Credits, and Recapture; and Illinois

Column F – If you wrote the fair market value of the property in

Schedule K-1-T, Beneficiary’s Share of Income and Deductions.

Column E, write in Column F the federal income tax basis of the

For installment sales, see instructions on the back of

property as of August 1, 1969. Federal income tax basis is the

Schedule F.

amount you would have written as ‘‘cost or other basis’’ on U.S.

Step 2 – August 1, 1969, Valuation Limitation

1040, Schedule D, or U.S. Form 6252 if you had sold the property on

August 1, 1969.

Amounts for Capital (Non-depreciable) Assets

If you wrote a fraction in Column E, leave Column F blank.

Line 1

Column G – If you wrote the fair market value of the property in

Column A – Write a description of the property or full name of

Column E, subtract Column F from Column E and write the difference.

security as shown on your U.S. 1040, Schedule D or U.S. Form 6252.

However, if Column F is equal to or greater than Column E, write zero.

Column B – Write the month and year you acquired the property. For

If you wrote a fraction in Column E, multiply Column D by the fraction

securities you acquired through the exercise of rights, warrants, or

and write the result.

options, write the date exercised.

Column H – Write the lesser of Column D or Column G.

Column C – Write the month and year you disposed of the property.

Line 2

Column D – Write the total gain in the taxable year for each property

Write your share of any pre-August 1, 1969, appreciation amounts for

as shown on U.S. 1040, Schedule D or U.S. Form 6252.

capital gains received from

If you reported gain on the sale of your home on U.S. Form

partnerships or S corporations as reported on Schedules K-1-P,

8949, write in Column D the amount of that gain minus any “Section

Partner's or Shareholder's Share of Income, Deductions, Credits,

121 exclusion” you reported for your home on U.S. Form 8949.

and Recapture, Step 6, Line 51.

Column E – Write the fair market value on August 1, 1969, or the

trusts or estates as reported on Schedules K-1-T, Beneficiary's

‘‘applicable fraction’’ for each property. Your entry for each property

Share of Income and Deductions, Step 6, Line 49.

will depend upon whether the property was a listed security on

You must include the amounts reported to you on all K-1-P

August 1, 1969, or, if it was not listed, whether you have an appraisal

schedules received from partnerships and S corporations and all

of its fair market value as of August 1, 1969. See below.

K-1-T schedules received from trusts and estates.

How do I determine the fair market value of my property?

Listed Securities: If the gain was from a security listed on a

Line 3

national securities exchange or quoted in the over-the-counter

Write any gain you realized from a sale of employer securities

market between July 28 and 31, 1969, determine the market value

received in a distribution from a qualified employee benefit plan. You

of the property on August 1, 1969, as follows:

will find the amount on Form IL-4644, Gains from Sales of Employer’s

If the security was traded between July 28 and 31, 1969, use the

Securities Received from a Qualified Employee Benefit Plan, Line 18.

price of the last sale during the period to value the security. If the

IL-1040 Schedule F Instructions front (R-12/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2