Payroll Office - Pay Stub Tutorial

ADVERTISEMENT

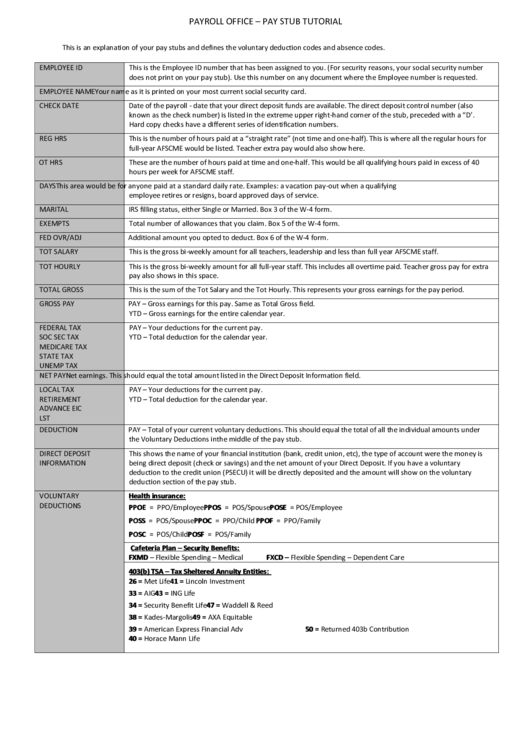

PAYROLL OFFICE – PAY STUB TUTORIAL

This is an explanation of your pay stubs and defines the voluntary deduction codes and absence codes.

EMPLOYEE ID

This is the Employee ID number that has been assigned to you. (For security reasons, your social security number

does not print on your pay stub). Use this number on any document where the Employee number is requested.

EMPLOYEE NAME

Your name as it is printed on your most current social security card.

CHECK DATE

Date of the payroll - date that your direct deposit funds are available. The direct deposit control number (also

known as the check number) is listed in the extreme upper right-hand corner of the stub, preceded with a “D’.

Hard copy checks have a different series of identification numbers.

REG HRS

This is the number of hours paid at a “straight rate” (not time and one-half). This is where all the regular hours for

full-year AFSCME would be listed. Teacher extra pay would also show here.

OT HRS

These are the number of hours paid at time and one-half. This would be all qualifying hours paid in excess of 40

hours per week for AFSCME staff.

DAYS

This area would be for anyone paid at a standard daily rate. Examples: a vacation pay-out when a qualifying

employee retires or resigns, board approved days of service.

MARITAL

IRS filling status, either Single or Married. Box 3 of the W-4 form.

EXEMPTS

Total number of allowances that you claim. Box 5 of the W-4 form.

FED OVR/ADJ

Additional amount you opted to deduct. Box 6 of the W-4 form.

TOT SALARY

This is the gross bi-weekly amount for all teachers, leadership and less than full year AFSCME staff.

TOT HOURLY

This is the gross bi-weekly amount for all full-year staff. This includes all overtime paid. Teacher gross pay for extra

pay also shows in this space.

TOTAL GROSS

This is the sum of the Tot Salary and the Tot Hourly. This represents your gross earnings for the pay period.

GROSS PAY

PAY – Gross earnings for this pay. Same as Total Gross field.

YTD – Gross earnings for the entire calendar year.

FEDERAL TAX

PAY – Your deductions for the current pay.

SOC SEC TAX

YTD – Total deduction for the calendar year.

MEDICARE TAX

STATE TAX

UNEMP TAX

NET PAY

Net earnings. This should equal the total amount listed in the Direct Deposit Information field.

LOCAL TAX

PAY – Your deductions for the current pay.

RETIREMENT

YTD – Total deduction for the calendar year.

ADVANCE EIC

LST

DEDUCTION

PAY – Total of your current voluntary deductions. This should equal the total of all the individual amounts under

the Voluntary Deductions in the middle of the pay stub.

DIRECT DEPOSIT

This shows the name of your financial institution (bank, credit union, etc), the type of account were the money is

INFORMATION

being direct deposit (check or savings) and the net amount of your Direct Deposit. If you have a voluntary

deduction to the credit union (PSECU) it will be directly deposited and the amount will show on the voluntary

deduction section of the pay stub.

VOLUNTARY

Health insurance:

DEDUCTIONS

PPOE = PPO/Employee

PPOS = POS/Spouse

POSE = POS/Employee

POSS = POS/Spouse

PPOC = PPO/Child

PPOF = PPO/Family

POSC = POS/Child

POSF = POS/Family

Cafeteria Plan – Security Benefits:

FXMD – Flexible Spending – Medical

FXCD – Flexible Spending – Dependent Care

403(b) TSA – Tax Sheltered Annuity Entities:

26 = Met Life

41 = Lincoln Investment

33 = AIG

43 = ING Life

34 = Security Benefit Life

47 = Waddell & Reed

38 = Kades-Margolis

49 = AXA Equitable

39 = American Express Financial Adv

50 = Returned 403b Contribution

40 = Horace Mann Life

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2