Sm2-3: Analyzing A Pay Stub

ADVERTISEMENT

SM2-3: Analyzing a Pay Stub

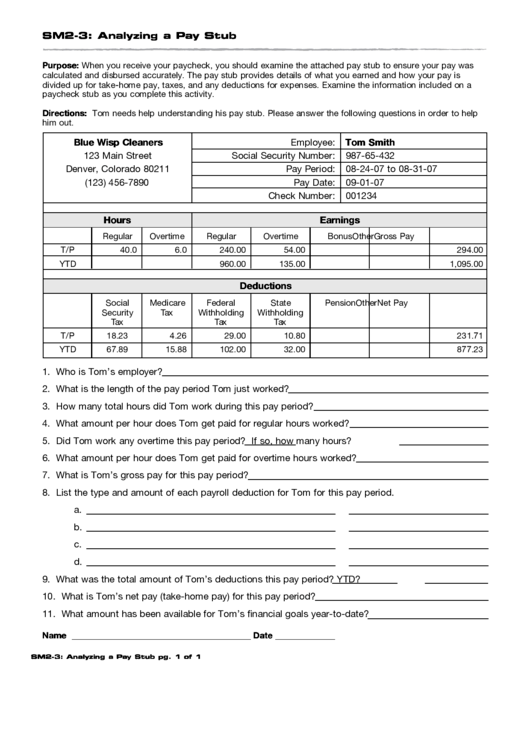

Purpose: When you receive your paycheck, you should examine the attached pay stub to ensure your pay was

calculated and disbursed accurately. The pay stub provides details of what you earned and how your pay is

divided up for take-home pay, taxes, and any deductions for expenses. Examine the information included on a

paycheck stub as you complete this activity.

Directions: Tom needs help understanding his pay stub. Please answer the following questions in order to help

him out.

Blue Wisp Cleaners

Employee:

Tom Smith

123 Main Street

Social Security Number:

987-65-432

Denver, Colorado 80211

Pay Period:

08-24-07 to 08-31-07

(123) 456-7890

Pay Date:

09-01-07

Check Number:

001234

Hours

Earnings

Regular

Overtime

Regular

Overtime

Bonus

Other

Gross Pay

T/P

40.0

6.0

240.00

54.00

294.00

YTD

960.00

135.00

1,095.00

Deductions

Social

Medicare

Federal

State

Pension

Other

Net Pay

Security

Tax

Withholding

Withholding

Tax

Tax

Tax

T/P

18.23

4.26

29.00

10.80

231.71

YTD

67.89

15.88

102.00

32.00

877.23

1. Who is Tom’s employer?

2. What is the length of the pay period Tom just worked?

3. How many total hours did Tom work during this pay period?

4. What amount per hour does Tom get paid for regular hours worked?

5. Did Tom work any overtime this pay period?

If so, how many hours?

6. What amount per hour does Tom get paid for overtime hours worked?

7. What is Tom’s gross pay for this pay period?

8. List the type and amount of each payroll deduction for Tom for this pay period.

a.

b.

c.

d.

9. What was the total amount of Tom’s deductions this pay period?

YTD?

10. What is Tom’s net pay (take-home pay) for this pay period?

11. What amount has been available for Tom’s financial goals year-to-date?

Name __________________________________________

Date ______________

SM2-3: Analyzing a Pay Stub

pg. 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1