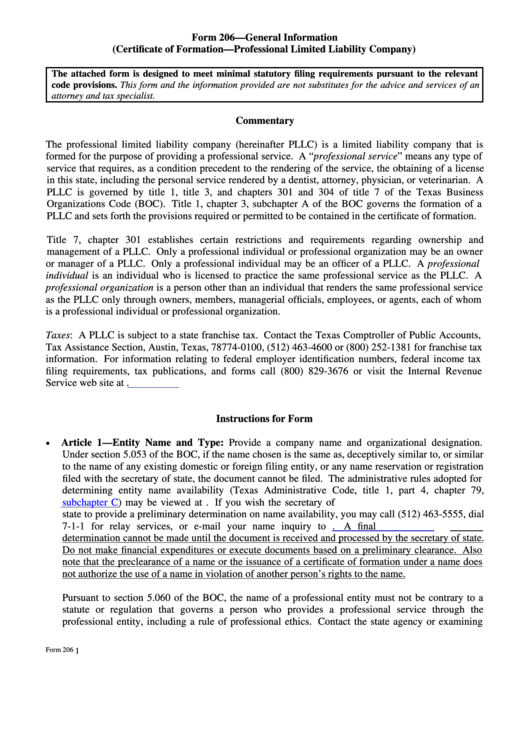

Form 206—General Information

(Certificate of Formation—Professional Limited Liability Company)

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant

code provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

The professional limited liability company (hereinafter PLLC) is a limited liability company that is

formed for the purpose of providing a professional service. A “professional service” means any type of

service that requires, as a condition precedent to the rendering of the service, the obtaining of a license

in this state, including the personal service rendered by a dentist, attorney, physician, or veterinarian. A

PLLC is governed by title 1, title 3, and chapters 301 and 304 of title 7 of the Texas Business

Organizations Code (BOC). Title 1, chapter 3, subchapter A of the BOC governs the formation of a

PLLC and sets forth the provisions required or permitted to be contained in the certificate of formation.

Title 7, chapter 301 establishes certain restrictions and requirements regarding ownership and

management of a PLLC. Only a professional individual or professional organization may be an owner

or manager of a PLLC. Only a professional individual may be an officer of a PLLC. A professional

individual is an individual who is licensed to practice the same professional service as the PLLC. A

professional organization is a person other than an individual that renders the same professional service

as the PLLC only through owners, members, managerial officials, employees, or agents, each of whom

is a professional individual or professional organization.

Taxes: A PLLC is subject to a state franchise tax. Contact the Texas Comptroller of Public Accounts,

Tax Assistance Section, Austin, Texas, 78774-0100, (512) 463-4600 or (800) 252-1381 for franchise tax

information. For information relating to federal employer identification numbers, federal income tax

filing requirements, tax publications, and forms call (800) 829-3676 or visit the Internal Revenue

Service web site at

Instructions for Form

Article 1—Entity Name and Type: Provide a company name and organizational designation.

Under section 5.053 of the BOC, if the name chosen is the same as, deceptively similar to, or similar

to the name of any existing domestic or foreign filing entity, or any name reservation or registration

filed with the secretary of state, the document cannot be filed. The administrative rules adopted for

determining entity name availability (Texas Administrative Code, title 1, part 4, chapter 79,

subchapter

C) may be viewed at If you wish the secretary of

state to provide a preliminary determination on name availability, you may call (512) 463-5555, dial

7-1-1 for relay services, or e-mail your name inquiry to corpinfo@sos.state.tx.us.

A final

determination cannot be made until the document is received and processed by the secretary of state.

Do not make financial expenditures or execute documents based on a preliminary clearance. Also

note that the preclearance of a name or the issuance of a certificate of formation under a name does

not authorize the use of a name in violation of another person’s rights to the name.

Pursuant to section 5.060 of the BOC, the name of a professional entity must not be contrary to a

statute or regulation that governs a person who provides a professional service through the

professional entity, including a rule of professional ethics. Contact the state agency or examining

Form 206

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7