Inventory And Appraisement

ADVERTISEMENT

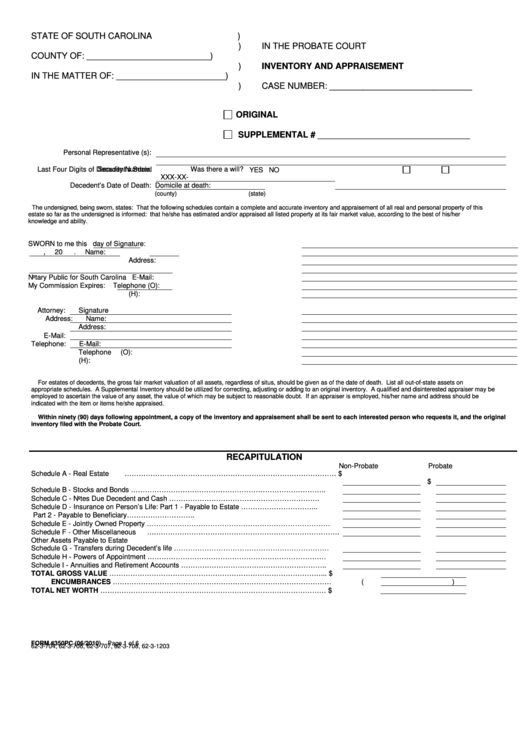

STATE OF SOUTH CAROLINA

)

)

IN THE PROBATE COURT

COUNTY OF: __________________________

)

)

INVENTORY AND APPRAISEMENT

IN THE MATTER OF: _______________________

)

)

CASE NUMBER: ______________________________

ORIGINAL

SUPPLEMENTAL # ________________________________

Personal Representative (s):

Last Four Digits of Decedent’s Social

Was there a will?

YES

NO

Security Number:

XXX-XX-

Decedent’s Date of Death:

Domicile at death:

(county)

(state)

The undersigned, being sworn, states: That the following schedules contain a complete and accurate inventory and appraisement of all real and personal property of this

estate so far as the undersigned is informed: that he/she has estimated and/or appraised all listed property at its fair market value, according to the best of his/her

knowledge and ability.

SWORN to me this

day of

Signature:

,

20

.

Name:

Address:

Notary Public for South Carolina

E-Mail:

My Commission Expires:

Telephone (O):

(H):

Attorney:

Signature

Address:

Name:

Address:

E-Mail:

Telephone:

E-Mail:

Telephone (O):

(H):

For estates of decedents, the gross fair market valuation of all assets, regardless of situs, should be given as of the date of death. List all out-of-state assets on

appropriate schedules. A Supplemental Inventory should be utilized for correcting, adjusting or adding to an original inventory. A qualified and disinterested appraiser may be

employed to ascertain the value of any asset, the value of which may be subject to reasonable doubt. If an appraiser is employed, his/her name and address should be

indicated with the item or items he/she appraised.

Within ninety (90) days following appointment, a copy of the inventory and appraisement shall be sent to each interested person who requests it, and the original

inventory filed with the Probate Court.

RECAPITULATION

Non-Probate

Probate

Schedule A - Real Estate

……………………………………………………………………………… $

$

Schedule B - Stocks and Bonds

………………………………………………………………………..

Schedule C - Notes Due Decedent and Cash

……………………………………………………….

Schedule D - Insurance on Person’s Life:

Part 1 - Payable to Estate

…………………………...

Part 2 - Payable to Beneficiary

………………………..

Schedule E - Jointly Owned Property

……………………………………………………………………

Schedule F - Other Miscellaneous

……………………………………………………………………….

Other Assets Payable to Estate

Schedule G - Transfers during Decedent’s life

…………………………………………………………

Schedule H - Powers of Appointment

………………………………………………………………….

Schedule I - Annuities and Retirement Accounts

……………………………………………………..

TOTAL GROSS VALUE

………………………………………………………………………………...

$

ENCUMBRANCES

…………………………………………………………………………………

(

)

TOTAL NET WORTH

……………………………………………………………………………………

$

FORM #350PC (06/2010)

Page 1 of 6

62-3-704, 62-3-706, 62-3-707, 62-3-708, 62-3-1203

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6