Statement Of Person Claiming Refund Due A Deceased Taxpayer Page 2

ADVERTISEMENT

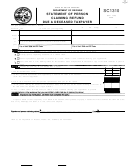

General Instructions for TC-131

Who must file:

Use form TC-131 to claim a refund on behalf of a deceased taxpayer, if there is no surviving spouse.

A surviving spouse who files a joint return with the deceased taxpayer is NOT required to file this form.

How to file:

Attach form TC-131, along with any other required documents, to the deceased taxpayer’s tax return.

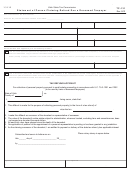

Who must complete the Affidavit:

The Affidavit must be completed by a successor (heir) of the decedent who:

1.

Meets the qualifications listed on the Affidavit;

2.

Is not required to file a probate for the decedent’s estate; and

3.

Is not required to be appointed as a personal representative to claim the decedent’s refund.

The successor (heir) must have the efund Affidavit notarized by signing it before a Notary Public.

R

If you are filing a joint return for the taxpayer and spouse, who both died during the year, complete the

Affidavit by entering only the primary taxpayer’s name and Social Security number on the TC-131.

Liability Release:

U. C. section 75-3-1202 releases the State receiving the affidavit (without requiring them to verify its

truthfulness) from any liability arising from incorrectly paying money to someone other than the

person entitled to it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2