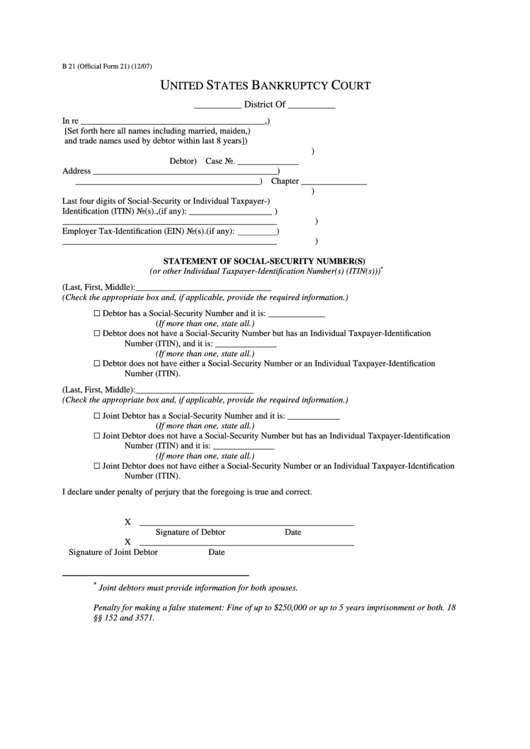

B 21 (Official Form 21) (12/07)

U

S

B

C

NITED

TATES

ANKRUPTCY

OURT

__________ District Of __________

In re __________________________________________,

)

[Set forth here all names including married, maiden,

)

and trade names used by debtor within last 8 years]

)

)

Debtor

) Case No. ______________

Address __________________________________________

)

__________________________________________

) Chapter _______________

)

Last four digits of Social-Security or Individual Taxpayer-

)

Identification (ITIN) No(s).,(if any): ___________________

)

_________________________________________________

)

Employer Tax-Identification (EIN) No(s).(if any):

)

_________________________________________________

)

STATEMENT OF SOCIAL-SECURITY NUMBER(S)

*

(or other Individual Taxpayer-Identification Number(s) (ITIN(s)))

1.Name of Debtor (Last, First, Middle):_______________________________

(Check the appropriate box and, if applicable, provide the required information.)

G Debtor has a Social-Security Number and it is: _____________

(If more than one, state all.)

G Debtor does not have a Social-Security Number but has an Individual Taxpayer-Identification

Number (ITIN), and it is: ______________

(If more than one, state all.)

G Debtor does not have either a Social-Security Number or an Individual Taxpayer-Identification

Number (ITIN).

2.Name of Joint Debtor (Last, First, Middle):___________________________

(Check the appropriate box and, if applicable, provide the required information.)

G Joint Debtor has a Social-Security Number and it is: ____________

(If more than one, state all.)

G Joint Debtor does not have a Social-Security Number but has an Individual Taxpayer-Identification

Number (ITIN) and it is: ______________

(If more than one, state all.)

G Joint Debtor does not have either a Social-Security Number or an Individual Taxpayer-Identification

Number (ITIN).

I declare under penalty of perjury that the foregoing is true and correct.

X _________________________________________________

Signature of Debtor

Date

X _________________________________________________

Signature of Joint Debtor

Date

*

Joint debtors must provide information for both spouses.

Penalty for making a false statement: Fine of up to $250,000 or up to 5 years imprisonment or both. 18

U.S.C. §§ 152 and 3571.

Reset

Save As...

Print

1

1