Print form

Clear form

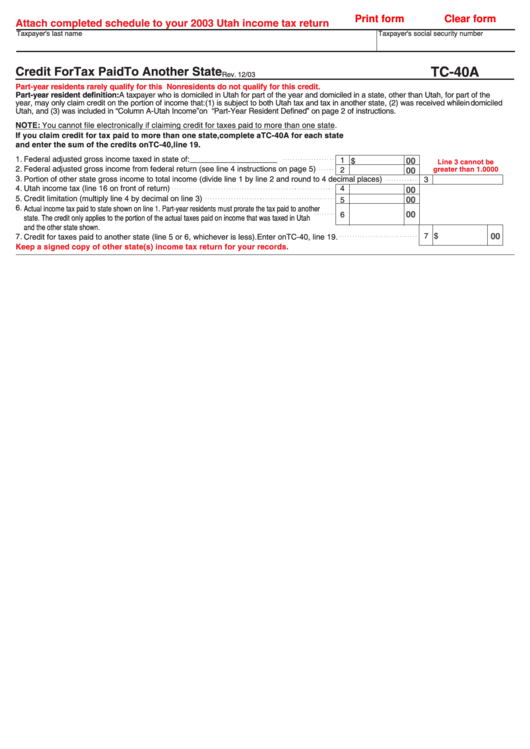

Attach completed schedule to your 2003 Utah income tax return

Taxpayer's last name

Taxpayer's social security number

Credit For Tax Paid To Another State

TC-40A

Rev. 12/03

Part-year residents rarely qualify for this credit.

Nonresidents do not qualify for this credit.

See instructions on page 10.

Part-year resident definition: A taxpayer who is domiciled in Utah for part of the year and domiciled in a state, other than Utah, for part of the

year, may only claim credit on the portion of income that: (1) is subject to both Utah tax and tax in another state, (2) was received while

domiciled

in

Utah, and (3) was included in “Column A-Utah Income” on TC-40C. Also see “Part-Year Resident Defined” on page 2 of instructions.

NOTE: You cannot file electronically if claiming credit for taxes paid to more than one state.

If you claim credit for tax paid to more than one state, complete a TC-40A for each state

and enter the sum of the credits on TC-40, line 19.

1.

Federal adjusted gross income taxed in state of: ____________________

1

00

$

Line 3 cannot be

2.

Federal adjusted gross income from federal return (see line 4 instructions on page 5)

greater than 1.0000

2

00

3.

Portion of other state gross income to total income (divide line 1 by line 2 and round to 4 decimal places)

3

4.

Utah income tax (line 16 on front of return)

4

00

5.

Credit limitation (multiply line 4 by decimal on line 3)

5

00

6.

Actual income tax paid to state shown on line 1. Part-year residents must prorate the tax paid to another

00

6

state. The credit only applies to the portion of the actual taxes paid on income that was taxed in Utah

and the other state shown.

00

7 $

7.

Credit for taxes paid to another state (line 5 or 6, whichever is less). Enter on TC-40, line 19.

Keep a signed copy of other state(s) income tax return for your records.

1

1