Print form

Clear form

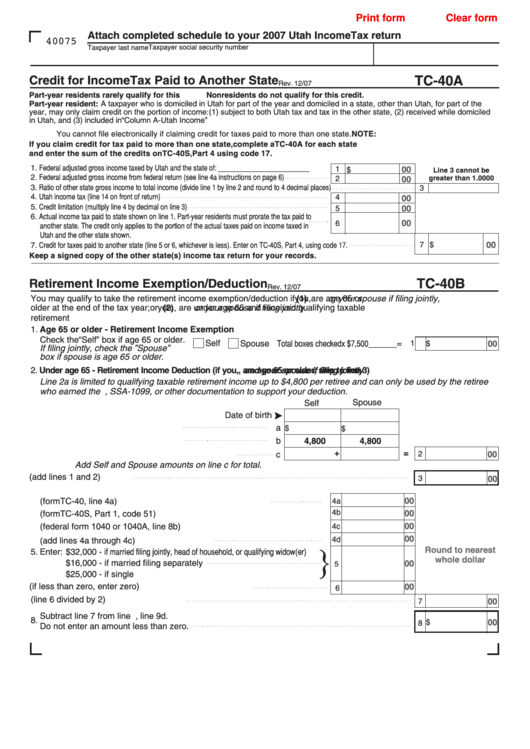

Attach completed schedule to your 2007 Utah Income Tax return

40075

Taxpayer social security number

Taxpayer last name

Credit for Income Tax Paid to Another State

TC-40A

Rev. 12/07

Part-year residents rarely qualify for this credit.

Nonresidents do not qualify for this credit.

See instructions on page 13.

Part-year resident:

A taxpayer who is domiciled in Utah for part of the year and domiciled in a state, other than Utah, for part of the

year, may only claim credit on the portion of income: (1) subject to both Utah tax and tax in the other state, (2) received while domiciled

in Utah, and (3) included in “Column A-Utah Income” on TC-40C. Also see Part-Year Resident Defined on page 3 of instructions.

NOTE:

You cannot file electronically if claiming credit for taxes paid to more than one state.

If you claim credit for tax paid to more than one state, complete a TC-40A for each state

and enter the sum of the credits on TC-40S, Part 4 using code 17.

1. Federal adjusted gross income taxed by Utah and the state of: _________________________

1

00

$

Line 3 cannot be

2. Federal adjusted gross income from federal return (see line 4a instructions on page 6)

greater than 1.0000

2

00

3. Ratio of other state gross income to total income (divide line 1 by line 2 and round to 4 decimal places)

3

4. Utah income tax (line 14 on front of return)

4

00

5. Credit limitation (multiply line 4 by decimal on line 3)

5

00

6. Actual income tax paid to state shown on line 1. Part-year residents must prorate the tax paid to

00

6

another state. The credit only applies to the portion of the actual taxes paid on income taxed in

Utah and the other state shown.

00

7. Credit for taxes paid to another state (line 5 or 6, whichever is less). Enter on TC-40S, Part 4, using code 17.

7 $

Keep a signed copy of the other state(s) income tax return for your records.

TC-40B

Retirement Income Exemption/Deduction

Rev. 12/07

or your spouse if filing jointly,

You may qualify to take the retirement income exemption/deduction if

(1)

you,

are age 65 or

or your spouse if filing jointly

older at the end of the tax year; or

(2)

you,

, are under age 65 and received qualifying taxable

retirement income. See pages 8 and 9 of instructions for definition of qualifying retirement income.

1. Age 65 or older - Retirement Income Exemption

Check the “Self” box if age 65 or older.

Self

Total boxes checked

x $7,500

1

00

Spouse

______

=

$

If filing jointly, check the ”Spouse”

box if spouse is age 65 or older.

2. Under age 65 - Retirement Income Deduction (if you,

and your spouse if filing jointly

, are age 65 or older, skip to line 3)

Line 2a is limited to qualifying taxable retirement income up to $4,800 per retiree and can only be used by the retiree

who earned the income. ATTACH ALL FORMS 1099-R, SSA-1099, or other documentation to support your deduction.

Spouse

Self

Date of birth

a. Qualified retirement income

a

$

$

b. Retirement income limitation

b

4,800

4,800

+

=

c

2

00

c. Enter the lesser of a or b for each column.

Add Self and Spouse amounts on line c for total.

3. Total (add lines 1 and 2)

3

00

4. Adjusted income

00

a. Enter federal adjusted gross income (form TC-40, line 4a)

4a

4b

00

b. Enter any lump sum distribution amount (form TC-40S, Part 1, code 51)

c. Enter non-taxable interest amount (federal form 1040 or 1040A, line 8b)

00

4c

00

4d

d. Adjusted income (add lines 4a through 4c)

Round to nearest

5. Enter:

$32,000 - if married filing jointly, head of household, or qualifying widow(er)

whole dollar

$16,000 - if married filing separately

00

5

$25,000 - if single

6. Subtract line 5 from line 4d (if less than zero, enter zero)

00

6

7. One-half of line 6 (line 6 divided by 2)

7

00

Subtract line 7 from line 3. This is your retirement exemption/deduction. Enter on TC-40, line 9d.

8.

$

00

8

Do not enter an amount less than zero.

1

1