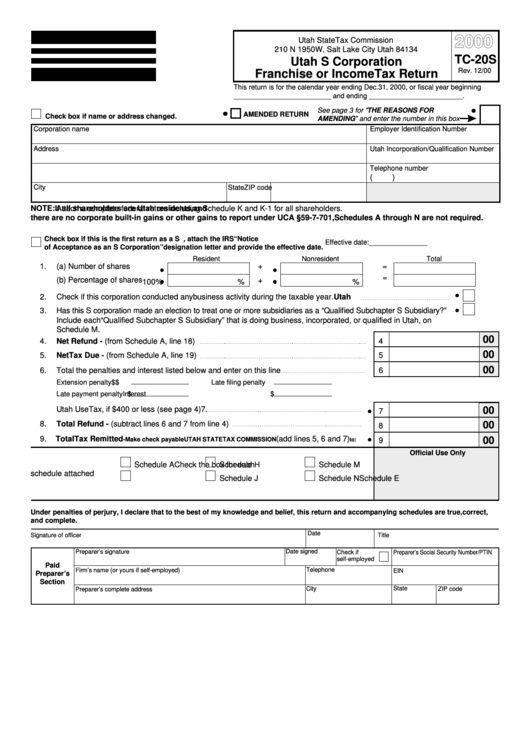

Utah S Corporation Franchise Or Income Tax Return 2000

ADVERTISEMENT

2000

Utah State Tax Commission

210 N 1950 W, Salt Lake City Utah 84134

TC-20S

Utah S Corporation

Rev. 12/00

Franchise or Income Tax Return

This return is for the calendar year ending Dec. 31, 2000, or fiscal year beginning

_________________________ and ending ________________________.

See page 3 for "

THE REASONS FOR

AMENDED RETURN

Check box if name or address changed.

AMENDING

" and enter the number in this box

Corporation name

Employer Identification Number

Address

Utah Incorporation/Qualification Number

Telephone number

(

)

City

State

ZIP code

NOTE:

Attach a complete federal return including Schedule K and K-1 for all shareholders.

If all shareholders are Utah residents, and

there are no corporate built-in gains or other gains to report under UCA §59-7-701, Schedules A through N are not required.

Check box if this is the first return as a S corporation. If so, attach the IRS “Notice

Effective date: _______________

of Acceptance as an S Corporation” designation letter and provide the effective date.

Resident

Nonresident

Total

1.

(a) Number of shares

+

=

=

(b) Percentage of shares

+

%

%

100%

2.

Check if this corporation conducted any

Utah

business activity during the taxable year.

3.

Has this S corporation made an election to treat one or more subsidiaries as a “Qualified Subchapter S Subsidiary?”

Include each “Qualified Subchapter S Subsidiary” that is doing business, incorporated, or qualified in Utah, on

Schedule M.

00

4.

Net Refund - (from Schedule A, line 18)

4

00

5.

Net Tax Due - (from Schedule A, line 19)

5

00

6.

Total the penalties and interest listed below and enter on this line

6

Extension penalty

$

Late filing penalty

$

Late payment penalty

$

Interest

$

7.

Utah Use Tax, if $400 or less (see page 4)

00

7

8.

Total Refund - (subtract lines 6 and 7 from line 4)

00

8

9.

Total Tax Remitted

(add lines 5, 6 and 7)

00

-

Make check payable

UTAH STATE TAX COMMISSION

to:

9

Official Use Only

Check the box for each

Schedule A

Schedule H

Schedule M

schedule attached

Schedule E

Schedule J

Schedule N

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and accompanying schedules are true, correct,

and complete.

Date

Signature of officer

Title

Date signed

Preparer’s signature

Check if

Preparer’s Social Security Number/PTIN

self-employed

Paid

Telephone

Firm’s name (or yours if self-employed)

EIN

Preparer’s

Section

City

State

ZIP code

Preparer’s complete address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8