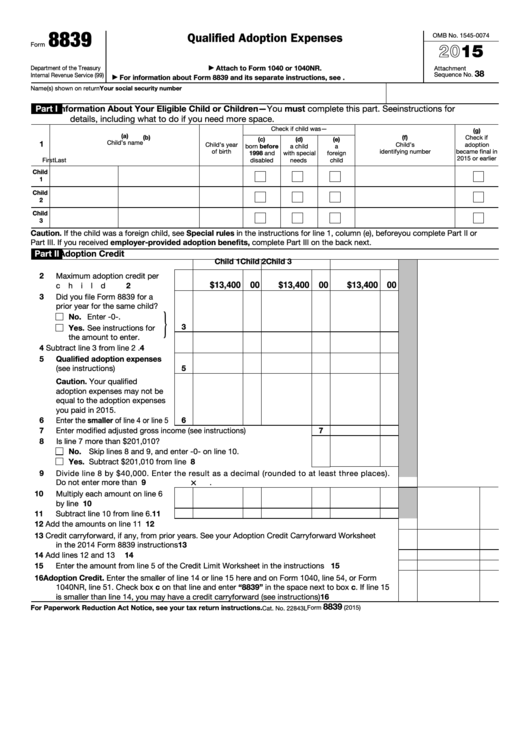

8839

Qualified Adoption Expenses

OMB No. 1545-0074

2015

Form

Attach to Form 1040 or 1040NR.

Department of the Treasury

Attachment

▶

38

Sequence No.

Internal Revenue Service (99)

For information about Form 8839 and its separate instructions, see

▶

Name(s) shown on return

Your social security number

Part I

Information About Your Eligible Child or Children—You must complete this part. See instructions for

details, including what to do if you need more space.

Check if child was—

(g)

(a)

(b)

(f)

Check if

(c)

(d)

(e)

1

Child’s name

Child’s year

Child’s

adoption

born before

a child

a

of birth

identifying number

became final in

1998 and

with special

foreign

2015 or earlier

First

Last

disabled

needs

child

Child

1

Child

2

Child

3

Caution. If the child was a foreign child, see Special rules in the instructions for line 1, column (e), before you complete Part II or

Part III. If you received employer-provided adoption benefits, complete Part III on the back next.

Part II

Adoption Credit

Child 1

Child 2

Child 3

2

Maximum adoption credit per

$13,400 00

$13,400 00

$13,400 00

2

child

.

.

.

.

.

.

.

.

3

Did you file Form 8839 for a

prior year for the same child?

}

No. Enter -0-.

3

Yes. See instructions for

the amount to enter.

4

Subtract line 3 from line 2

.

4

5

Qualified adoption expenses

(see instructions)

.

.

.

.

5

Caution.

Your

qualified

adoption expenses may not be

equal to the adoption expenses

you paid in 2015.

6

Enter the smaller of line 4 or line 5

6

7

7

Enter modified adjusted gross income (see instructions) .

.

.

.

.

.

8

Is line 7 more than $201,010?

No. Skip lines 8 and 9, and enter -0- on line 10.

Yes. Subtract $201,010 from line 7 .

8

.

.

.

.

.

.

.

.

.

.

9

Divide line 8 by $40,000. Enter the result as a decimal (rounded to at least three places).

×

Do not enter more than 1.000 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

.

10

Multiply each amount on line 6

by line 9

.

.

.

.

.

.

.

10

11

Subtract line 10 from line 6 .

11

12

Add the amounts on line 11 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

Credit carryforward, if any, from prior years. See your Adoption Credit Carryforward Worksheet

in the 2014 Form 8839 instructions

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14

Add lines 12 and 13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

15

15

Enter the amount from line 5 of the Credit Limit Worksheet in the instructions

.

.

.

.

.

.

16

Adoption Credit. Enter the smaller of line 14 or line 15 here and on Form 1040, line 54, or Form

1040NR, line 51. Check box c on that line and enter “8839” in the space next to box c. If line 15

16

is smaller than line 14, you may have a credit carryforward (see instructions) .

.

.

.

.

.

.

8839

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2015)

Cat. No. 22843L

1

1 2

2