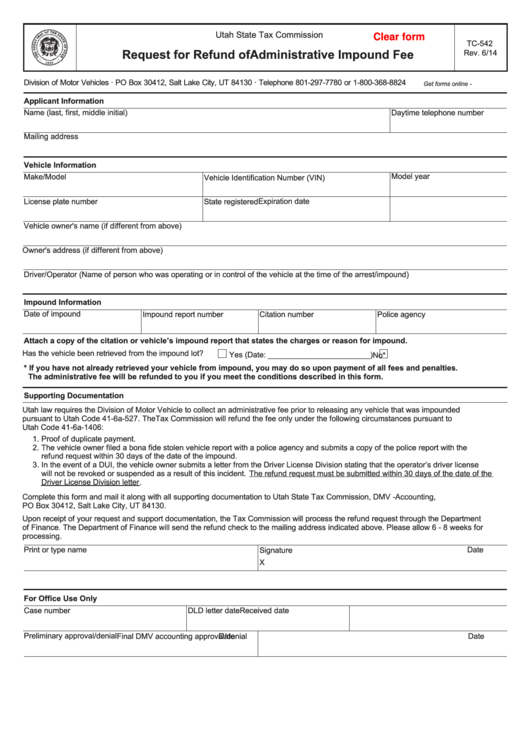

Utah State Tax Commission

Clear form

TC-542

Request for Refund of Administrative Impound Fee

Rev. 6/14

Division of Motor Vehicles · PO Box 30412, Salt Lake City, UT 84130 · Telephone 801-297-7780 or 1-800-368-8824

Get forms online - tax.utah.gov

Applicant Information

Name (last, first, middle initial)

Daytime telephone number

Mailing address

Vehicle Information

Make/Model

Model year

Vehicle Identification Number (VIN)

License plate number

State registered

Expiration date

Vehicle owner's name (if different from above)

Owner's address (if different from above)

Driver/Operator (Name of person who was operating or in control of the vehicle at the time of the arrest/impound)

Impound Information

Date of impound

Citation number

Police agency

Impound report number

Attach a copy of the citation or vehicle’s impound report that states the charges or reason for impound.

Has the vehicle been retrieved from the impound lot?

Yes (Date: ________________________)

No*

* If you have not already retrieved your vehicle from impound, you may do so upon payment of all fees and penalties.

The administrative fee will be refunded to you if you meet the conditions described in this form.

Supporting Documentation

Utah law requires the Division of Motor Vehicle to collect an administrative fee prior to releasing any vehicle that was impounded

pursuant to Utah Code 41-6a-527. The Tax Commission will refund the fee only under the following circumstances pursuant to

Utah Code 41-6a-1406:

1. Proof of duplicate payment.

2. The vehicle owner filed a bona fide stolen vehicle report with a police agency and submits a copy of the police report with the

refund request within 30 days of the date of the impound.

3. In the event of a DUI, the vehicle owner submits a letter from the Driver License Division stating that the operator’s driver license

will not be revoked or suspended as a result of this incident.

The refund request must be submitted within 30 days of the date of the

Driver License Division letter

.

Complete this form and mail it along with all supporting documentation to Utah State Tax Commission, DMV - Accounting,

PO Box 30412, Salt Lake City, UT 84130.

Upon receipt of your request and support documentation, the Tax Commission will process the refund request through the Department

of Finance. The Department of Finance will send the refund check to the mailing address indicated above. Please allow 6 - 8 weeks for

processing.

Print or type name

Date

Signature

X

For Office Use Only

Case number

DLD letter date

Received date

Preliminary approval/denial

Date

Final DMV accounting approval/denial

Date

1

1