2004 Annual Premium Tax Return

ADVERTISEMENT

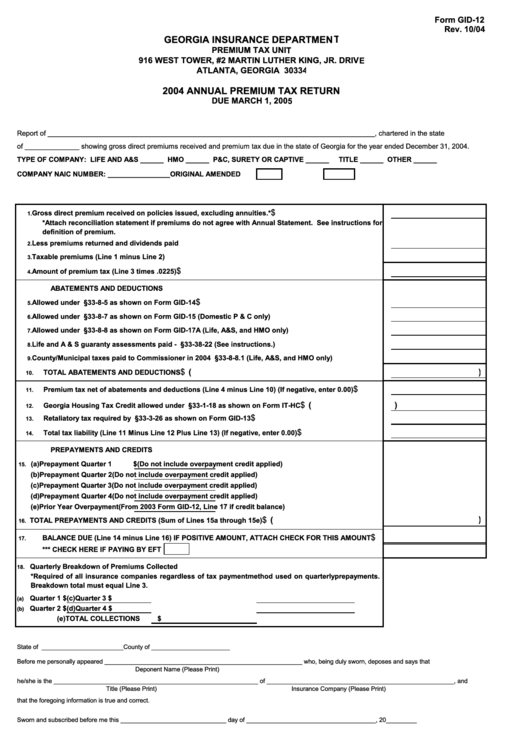

Form GID-12

Rev. 10/04

GEORGIA INSURANCE DEPARTMENT

PREMIUM TAX UNIT

916 WEST TOWER, #2 MARTIN LUTHER KING, JR. DRIVE

ATLANTA, GEORGIA 30334

2004 ANNUAL PREMIUM TAX RETURN

DUE MARCH 1, 2005

Report of ____________________________________________________________________________________, chartered in the state

of ______________ showing gross direct premiums received and premium tax due in the state of Georgia for the year ended December 31, 2004.

TYPE OF COMPANY: LIFE AND A&S ______ HMO ______ P&C, SURETY OR CAPTIVE ______

TITLE ______ OTHER ______

COMPANY NAIC NUMBER: ________________

ORIGINAL

AMENDED

$

Gross direct premium received on policies issued, excluding annuities.*

1.

*Attach reconciliation statement if premiums do not agree with Annual Statement. See instructions for

definition of premium.

Less premiums returned and dividends paid

2.

Taxable premiums (Line 1 minus Line 2)

3.

$

Amount of premium tax (Line 3 times .0225)

4.

ABATEMENTS AND DEDUCTIONS

$

Allowed under O.C.G.A. §33-8-5 as shown on Form GID-14

5.

Allowed under O.C.G.A. §33-8-7 as shown on Form GID-15 (Domestic P & C only)

6.

Allowed under O.C.G.A. §33-8-8 as shown on Form GID-17A (Life, A&S, and HMO only)

7.

Life and A & S guaranty assessments paid - O.C.G.A. §33-38-22 (See instructions.)

8.

County/Municipal taxes paid to Commissioner in 2004 O.C.G.A. §33-8-8.1 (Life, A&S, and HMO only)

9.

$ (

)

TOTAL ABATEMENTS AND DEDUCTIONS

10.

$

Premium tax net of abatements and deductions (Line 4 minus Line 10) (If negative, enter 0.00)

11.

$ (

)

Georgia Housing Tax Credit allowed under O.C.G.A. §33-1-18 as shown on Form IT-HC

12.

$

Retaliatory tax required by O.C.G.A. §33-3-26 as shown on Form GID-13

13.

$

Total tax liability (Line 11 Minus Line 12 Plus Line 13) (If negative, enter 0.00)

14.

PREPAYMENTS AND CREDITS

(a) Prepayment Quarter 1

$

(Do not include overpayment credit applied)

15.

(b) Prepayment Quarter 2

(Do not include overpayment credit applied)

(c) Prepayment Quarter 3

(Do not include overpayment credit applied)

(d) Prepayment Quarter 4

(Do not include overpayment credit applied)

(e) Prior Year Overpayment

(From 2003 Form GID-12, Line 17 if credit balance)

$ (

)

TOTAL PREPAYMENTS AND CREDITS (Sum of Lines 15a through 15e)

16.

$

BALANCE DUE (Line 14 minus Line 16) IF POSITIVE AMOUNT, ATTACH CHECK FOR THIS AMOUNT

17.

*** CHECK HERE IF PAYING BY EFT

Quarterly Breakdown of Premiums Collected

18.

*Required of all insurance companies regardless of tax payment method used on quarterly prepayments.

Breakdown total must equal Line 3.

Quarter 1 $

(c) Quarter 3 $

(a)

Quarter 2 $

(d) Quarter 4 $

(b)

(e) TOTAL COLLECTIONS

$

State of ________________________

County of _______________________

Before me personally appeared __________________________________________________________ who, being duly sworn, deposes and says that

Deponent Name (Please Print)

he/she is the ____________________________________________________________ of _______________________________________________________, and

Title (Please Print)

Insurance Company (Please Print)

that the foregoing information is true and correct.

Sworn and subscribed before me this _______________________________ day of ______________________________________, 20_________

Notary Public (Signature)--(Attach Seal)

Deponent (Signature)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1