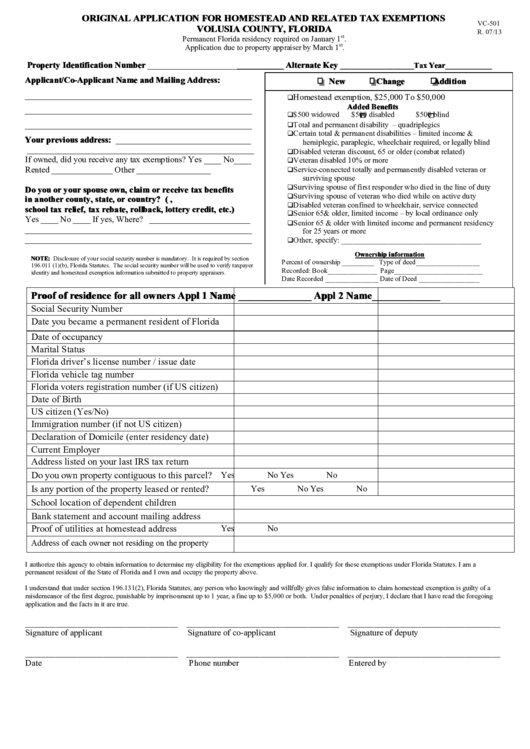

ORIGINAL APPLICATION FOR HOMESTEAD AND RELATED TAX EXEMPTIONS

VC-501

VOLUSIA COUNTY, FLORIDA

R. 07/13

st

Permanent Florida residency required on January 1

.

st

Application due to property appraiser by March 1

.

Property Identification Number

Alternate Key

____________

___________________Tax Year____________

Applicant/Co-Applicant Name and Mailing Address:

New

Change

Addition

____________________________________________________

Homestead exemption, $25,000 To $50,000

Added Benefits

____________________________________________________

$500 widowed

$500 disabled

$500 blind

Total and permanent disability – quadriplegics

____________________________________________________

Certain total & permanent disabilities – limited income &

Your previous address: _______________________________

hemiplegic, paraplegic, wheelchair required, or legally blind

____________________________________________________

Disabled veteran discount, 65 or older (combat related)

If owned, did you receive any tax exemptions? Yes ____ No____

Veteran disabled 10% or more

Rented ______________ Other _________________

Service-connected totally and permanently disabled veteran or

surviving spouse

Surviving spouse of first responder who died in the line of duty

Do you or your spouse own, claim or receive tax benefits

Surviving spouse of veteran who died while on active duty

in another county, state, or country? (i.e. Homestead,

Disabled veteran confined to wheelchair, service connected

school tax relief, tax rebate, rollback, lottery credit, etc.)

Senior 65& older, limited income – by local ordinance only

Yes ____ No ____ If yes, Where? _______________________

Senior 65 & older with limited income and permanent residency

____________________________________________________

for 25 years or more

____________________________________________________

Other, specify: ____________________________________

Ownership information

NOTE: Disclosure of your social security number is mandatory. It is required by section

Percent of ownership _________ Type of deed__________________

196.011 (1)(b), Florida Statutes. The social security number will be used to verify taxpayer

Recorded: Book______________ Page_________________________

identity and homestead exemption information submitted to property appraisers.

Date Recorded _______________ Date of Deed _________________

Proof of residence for all owners

Appl 1 Name ______________ Appl 2 Name_____________

Social Security Number

Date you became a permanent resident of Florida

Date of occupancy

Marital Status

Florida driver’s license number / issue date

Florida vehicle tag number

Florida voters registration number (if US citizen)

Date of Birth

US citizen (Yes/No)

Immigration number (if not US citizen)

Declaration of Domicile (enter residency date)

Current Employer

Address listed on your last IRS tax return

Do you own property contiguous to this parcel?

Yes

No

Yes

No

Is any portion of the property leased or rented?

Yes

No

Yes

No

School location of dependent children

Bank statement and account mailing address

Proof of utilities at homestead address

Yes

No

Address of each owner not residing on the property

I authorize this agency to obtain information to determine my eligibility for the exemptions applied for. I qualify for these exemptions under Florida Statutes. I am a

permanent resident of the State of Florida and I own and occupy the property above.

I understand that under section 196.131(2), Florida Statutes, any person who knowingly and willfully gives false information to claim homestead exemption is guilty of a

misdemeanor of the first degree, punishable by imprisonment up to 1 year, a fine up to $5,000 or both. Under penalties of perjury, I declare that I have read the foregoing

application and the facts in it are true.

___________________________________ ___________________________________ ___________________________________

Signature of applicant

Signature of co-applicant

Signature of deputy

___________________________________ ___________________________________ ___________________________________

Date

Phone number

Entered by

1

1 2

2